A Drunken Saylor

“Once you know how it all ends, the only use of time is…how do I buy more bitcoin? But take all your money and buy bitcoin. Then take all your time, figure out how to borrow more money to buy more bitcoin. Then take all your time and figure out what you can sell to buy bitcoin. And if you absolutely love the thing, that you don’t want to sell it, go mortgage your house and buy bitcoin with it. And if you’ve got a business that you love because your family works for the business and it’s in your family for 37 years, and you can’t bear to sell it, mortgage it, finance it, and convert the proceeds into the hardest money on earth, which is bitcoin.” – Michael Saylor

I occasionally come across something on Twitter that is so jarring I assume it must be fake. A few weeks ago, a video was trending that captured Michael Saylor, co-founder and CEO of MicroStrategy Incorporated, passionately articulating the quote I transcribed above. I clicked on the video link and literally spit out my poultry feed. This can’t be real, I said to myself. Surely, no officer of a US-listed publicly traded company would utter something so profoundly irresponsible. I know we live in the golden era of fraud (hat tip to Jim Chanos for that line), and I know the Securities and Exchange Commission (SEC) has totally abrogated its duty to police malfeasance in our capital markets, but surely nobody would so blatantly cross the line like this. So began my multi-week journey into Michael Saylor and MicroStrategy, and to quote the late, great Charlie Murphy, it turns out he is a habitual line-stepper.

We begin on December 14, 2000, when the SEC brought and simultaneously settled administrative reporting charges against MicroStrategy and civil accounting fraud charges against its executive officers, most notably Michael Saylor himself. Back then, the SEC occasionally cared about protecting investors from fraud. As part of the settlement, Saylor disgorged $8.28 million of ill-gotten gains, consented to a fraud injunction, and paid a fine of $350,000. In the year 2000, $8.63 million was considered a lot of money. Here’s how the SEC described it in the press release announcing their action:

“The Commission alleges that from the time of its initial public offering in June 1998 through March 2000, MicroStrategy, a Vienna, Virginia-based software company, materially overstated its revenues and earnings from the sale of software and services contrary to Generally Accepted Accounting Principles. The company's public financial reports during this time showed positive net income. In fact, the Commission alleges, MicroStrategy should have reported net losses from 1997 through the present.”

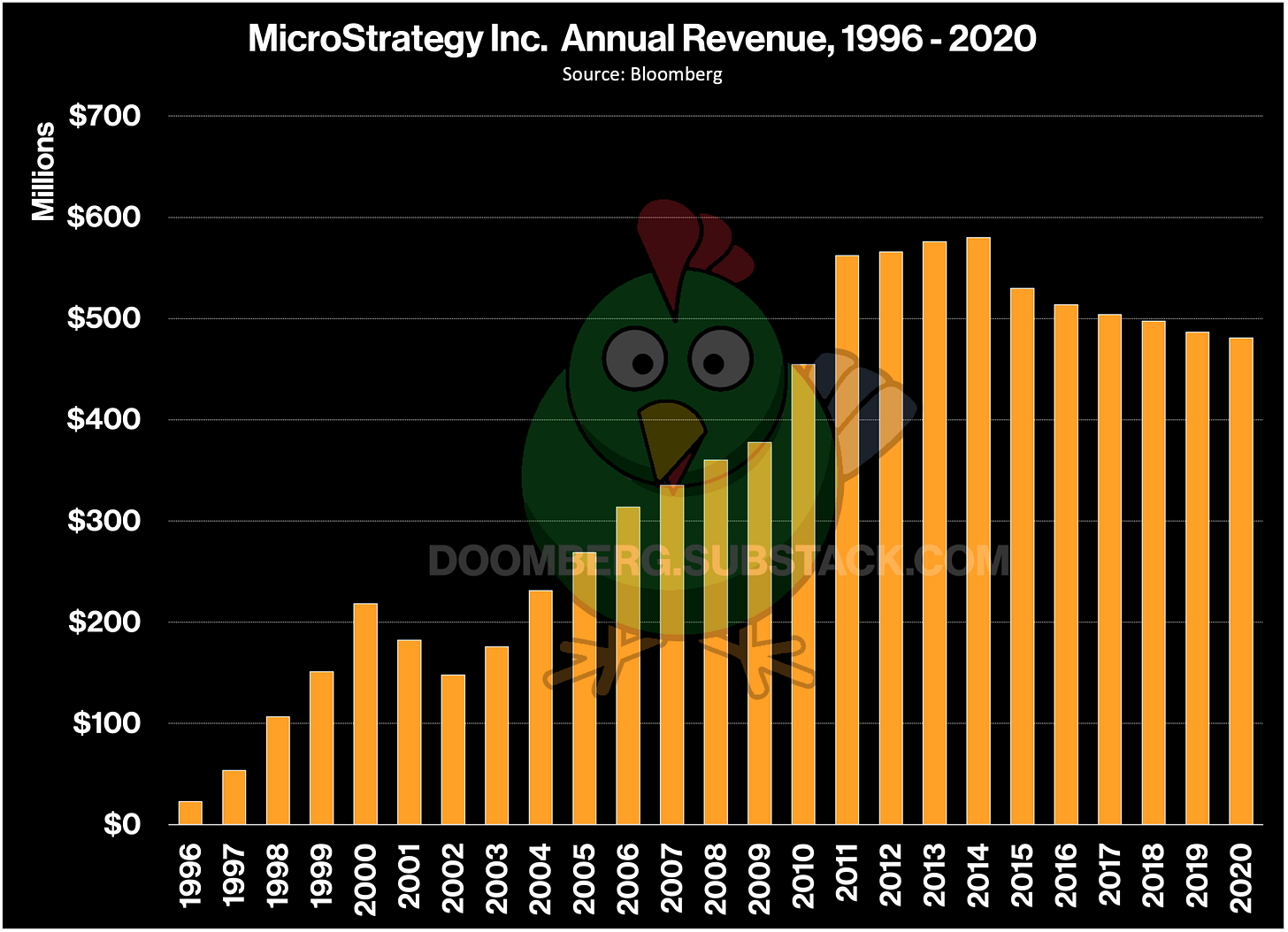

Fast forward about 20 years to mid-2020. MicroStrategy is a no-growth (but free cash flow positive) software provider sitting on about $500 million in cash. Saylor, who owns 25% of MicroStrategy’s stock, makes a fateful decision. With a market cap of $1.2 billion, his ownership of MicroStrategy is worth approximately $300 million. As we’ll see, Saylor isn’t the settle-for-being-a-centi-millionaire type, so he decides to do something totally unique. He goes all in on bitcoin.

On August 11, 2020, Saylor and MicroStrategy shocked the investing world by revealing they had spent $250 million of shareholder money to purchase 21,454 bitcoins at an average price of $11,652 each. Recognizing the significant risk of a negative market reaction, Saylor hedged his bluff. MicroStrategy’s stock had closed at $123.62 the day prior. Concurrent with the bitcoin announcement, the company also revealed it was willing to repurchase up to $250 million of the company’s stock at up to $140 a share, a 13% premium to the prior close. Here’s the text from the 8K filed with the SEC:

“On August 11, 2020, the Company also issued a press release announcing that the Company has commenced a “modified Dutch Auction” tender offer to purchase up to $250.0 million in value of shares of its issued and outstanding class A common stock, or such lesser number of shares as are properly tendered and not properly withdrawn, at a price not greater than $140.00 nor less than $122.00 per share. A copy of this press release is attached as Exhibit 99.2 to this Current Report on Form 8-K.”

The bluff worked, and so did Saylor’s bet on bitcoin. MicroStrategy’s stock quickly rose to above the repurchase offer. Ultimately, the company only ended up spending $60.5 million on the modified Dutch auction and used the remaining money to, wait for it, buy more bitcoin!

In the subsequent months, the price of bitcoin soared, MicroStrategy’s stock soared alongside it, and Saylor became an unrelenting evangelist for bitcoin, regularly appearing on virtually any podcast/YouTube channel/conference event that would have him. There were many takers, and to Saylor’s credit, he is a stout, crisp, articulate and passionate bitcoin evangelist. Some might say borderline maniacal. Well, I’ll go ahead and say it, at least. Saylor sounds unhinged as he makes the case for bitcoin. This is not a normal human being.

Saylor also continued to put his shareholder’s money where his mouth was, regularly using the rest of the company’s cash (and any new cash flow generated by the underlying software business) to buy more bitcoin. When those funds ran dry, Saylor officially crossed the Rubicon. On December 7, 2020, with the stock trading at $330 a share and bitcoin trading at $19,000, MicroStrategy announced its intent to issue debt in the form of unsecured convertible bonds to buy more bitcoin. Naturally, the deal was oversubscribed and upsized to $650 million. Stonks and whatnot.

On February 9, 2021, with bitcoin over $47,000, MicroStrategy stock reached an intraday all-time high of $1,315 a share, a ten-fold increase since Saylor embarked on his bitcoin adventure. His stake in MicroStrategy soared to above $3 billion, on paper at least.

What is a responsible steward of shareholder value, err, degenerate gambler to do? This might come as a surprise to you, but Saylor isn’t the settle-for-being-a-low-single-digit-billionaire type either. A week after MicroStrategy’s stock topped, he went back to the debt market, this time raising $1.05 billion in a new unsecured convertible debt offering to buy yet more bitcoin. This time, however, he seems to have nearly top-ticked the bitcoin price. After reaching $57,000 in the aftermath of Saylor’s latest gambit, bitcoin treaded water for the next three months, before collapsing by ~50% in mid-May to the mid-$30,000s.

Just when I thought Saylor was out of Rubicons to cross, he found another. Having tapped out the unsecured debt market, Saylor literally mortgaged MicroStrategy’s software business to raise yet another $500 million of debt, but this time it was of the secured variety. That’s right, by issuing a straight bond with a 6.125% coupon, secured by the assets and future cash flows of the software business, Saylor simultaneously screwed over the previous buyers of the unsecured convertible debt (by cramming them down the cap table behind the new bondholders) and tripled down on his bitcoin parlay.

Yesterday morning, Saylor took to Twitter to announce what MicroStrategy did with the newly raised funds:

“MicroStrategy has purchased an additional 13,005 bitcoins for ~$489 million in cash at an average price of ~$37,617 per bitcoin. As of 6/21/21 we #hodl ~105,085 bitcoins acquired for ~$2.741 billion at an average price of ~$26,080 per bitcoin. $MSTR”

We are now in a position to develop a simple model to analyze the value of MicroStrategy in light of these developments. Below is the full capital table for MicroStrategy as of the close of market trading yesterday, June 21, 2021:

MicroStrategy consists of two assets: the software business and its horde of bitcoins. I assign the full value of the software business to the new 1st lien senior secured debt holders. Trust me, I’ve done the math, in a liquidation scenario the software business barely covers the new secured obligations. I then assign the full value of the bitcoins to the two unsecured convertible debt holders and the company’s stock.

What is the market cap of the two convertible notes and the company’s stock? That’s a simple enough math exercise. The first convert has a face value of $650 million and is selling at $161.14 (par value is $100). The market is thus assigning a value of $1.047 billion to those notes – which makes sense since the stock price is well above the conversion price of the embedded option in the convert. The second convert, which has a much higher strike price and is currently deeply out of the money, has a face value of $1.05 billion but is selling for only $71.68. The market is thus assigning a value of $753 million to that note. Combined, the two converts fetch a market value of $1.047 + $0.753 = $1.80 billion.

The market capitalization of MicroStrategy’s stock is $5.69 billion. Therefore, the total value of the converts plus the stock is $1.80 + $5.69 = $7.49 billion. If we assign the 105,085 bitcoins to these asset classes, that works out to $7.49 billion/105,085 = $71,275 per bitcoin!

You read that correctly – $71,275 per bitcoin. The price of bitcoin is in the low $30,000s overnight. Therefore, the market is assigning more than twice the value to MicroStrategy’s unsecured classes than the underlying assets (the bitcoins) can support. This is truly a remarkable and unique situation.

Doubt my analysis? Saylor sure doesn’t. Having tapped out the unsecured debt market and fully mortgaged the software business, Saylor announced in a SEC filing that MicroStrategy would sell up to one billion new shares of equity. In Saylor’s mind, which is fully supported by the analysis presented here, MicroStrategy’s stock is overpriced compared to bitcoin. He intends to sell more of his stock and buy more bitcoin until that arbitrage is closed.

What do I think Saylor’s endgame is here? I predict that when the time is right, Saylor will pledge the majority of his MicroStrategy stock as collateral for a personal loan. By doing so, he will transfer the downside risk of his recklessness to the lending banks and other MicroStrategy equity holders, while maintaining all the upside if bitcoin goes to the moon. There will be no shortage of greedy banks to underwrite Saylor’s desire, assuming he gets the chance.

How is this legal? It is probably a silly question to ask in this environment, but surely Saylor has fully converted MicroStrategy into a bitcoin holding company at this point. He continuously makes wildly outrageous statements about the value of bitcoin, none of which are protected by safe harbor laws. These statements have a direct impact on the value of MicroStrategy’s stock, and by extension Saylor’s personal wealth. He encourages people to risk their entire life savings and follow him into the bitcoin abyss. It is truly a grotesque situation.

I should close with a reminder that nothing you read on Doomberg should be considered investment advice. In particular, I’ve concluded MicroStrategy is not tradeable. Is MicroStrategy wildly overvalued given the assets it holds, the debts it owes, and the risks it has taken on? Absolutely! Does that make it tradeable? Absolutely not! At least not to me. MicroStrategy has a high stonk potential – the Reddit crowd could rally to Saylor’s defense at any moment. In today’s market, the more outrageous a CEO behaves, the higher their stock can go. It’s especially dangerous to bet against a habitual line-stepper.

If you enjoy Doomberg, sign up yourself and share a link with your most paranoid friend!

saylor is doing what smart leaders must do... they take (calculated) risks to super-size investment (investor) outcomes. doesn't always work, but, when it does... it really does.

Mr. Doomberg has never ran a Full Bitcoin Node, never studied distributed cryptographically secured cyberspace asset network.He uses Bloomberg Terminal a software product to do his trading and investing in a centralized companies perpetuating booms and bust since the invention of stock market taking $ from the poor and giving it to the greedy Rich Wall Streeters. He fails to see the dichotomy, he himself is using software/hardware technology yet he abhors a software invention which automates the function of centralized Govt, political, gun-backed Scam Coins such as Peso, Lira, Euro adored and perpetuated by the Wall Street beneficiaries. Automation in network software will cancel Wall St fund managers, stock peddlers, mutual funds and 401k peddlers, In the near future, consumers will self manage their savings, 401k, and asset investing relying on automated asset network technology like Bitcoin. Bitcoin is not equal to MSTR, its not equal to Oracle, Google, Apple, or IBM. It's automated central banking for the 8Billion humans without Jay Poorwell, Chris Laggard, Mario Draggdio, and all other central banksters who have cheated humanity for over 100yrs. Their time is UP, and Bitcoin and distributed network technology will all obselete all of them including your Bloomberg Terminal. Everything all financial data, transactions on an open network with full transparency, criminals, nefarios try your nefario behavior and you'll be caught in no time, thanks for full transparency nature of the network.