A Stablecoin Applies to Become a Stonk

“I think it’s only Congress that could really address it. It would be good to consider – you asked my thoughts – to consider whether to bring greater investor protection to the crypto exchanges. Because right now the exchanges trading in these crypto assets do not have a regulatory framework, either at the SEC or our sister agency the Commodity Futures Trading Commission. That could instill greater confidence. Right now, there’s not a market regulator around these crypto exchanges, and thus there’s not protection against fraud or manipulation.” – Gary Gensler

Gary Gensler, Chairman of the Securities and Exchange Commission (SEC), might feel like he does not have the authority to regulate crypto, but he certainly has full authority to regulate the stock market. That’s what makes Circle’s attempt to go public via a special purpose acquisition company (SPAC) so interesting.

For those of you that may have missed it, Circle – the company behind the stablecoin USDC, which I’ve written about here, here, here, and here – announced last week that it would seek to merge with Concord Acquisition Corp and become a publicly traded company. A screen shot of the opening paragraphs of the announcement by Circle’s CEO, Jeremy Allaire, is reproduced below:

Not surprisingly, much of the financial media and the bullish crypto community are reacting as though the merger (1) is absolutely certain to close as described, and (2) somehow validates USDC. Look at Circle’s press release. It uses definitive statements like “to become,” “will result,” and “have accomplished.” You’ll notice, in contrast, that I’m specifically using contingent language like “applies to become,” “attempt to go public,” and “seek to merge.” At the moment, the agreement between Concord and Circle is nothing more than that – an agreement between two parties. There’s a long and likely complex regulatory road ahead before the deal actually consummates and Circle begins trading in the US stock market. That road runs right through the SEC.

As it turns out, this particular chicken has a fair bit of experience in the SPAC arena and has been observing the SEC’s stance toward such transactions with great interest for some time. For those unfamiliar, a SPAC is a shell company that raises money, goes public via an IPO, and then seeks to merge with a private company, thereby bringing that private company public through a bit of a backdoor. Euphemistically called “blank check companies,” SPACs are an interesting (if oft-abused) alternative to traditional IPOs because they allow private companies to become public with substantially less direct disclosure and substantially more leeway with regard to rosy future projections of growth.

At least that used to be the case.

Turn back the clock to about a year ago. The SEC, then chaired by friendly conflict-of-interest-laden lawyer-about-town Jay Clayton, had a distinctly laissez-faire attitude about all manner of what had heretofore been considered grievous offenses. The unofficial policy of Mr. Clayton seems to have been as long as the rich were getting richer, there was no such thing as white-collar crime. That didn’t mean little people could profit from illicit behavior, however. The SEC under Clayton worked small to big, nailing peasants for gains as small as tens- or hundreds of thousands of dollars in what’s colloquially known as “enforcement theater,” while centi-millionaires and billionaires embarked on an orgy of self-enrichment, gleefully pressing their newfound license-to-fleece to the maximum advantage possible. Under Clayton’s watch, the SPAC boom soared to historic heights.

But from the early signs, Gary Gensler is no Jay Clayton. For one thing, they have completely different names. Also, Gensler has signaled his desire to return the SEC to its more traditional role of, you know, enforcing securities laws and protecting investors. Two early areas of focus for Gensler? Crypto and SPACs. In fact, Gensler essentially knee-capped the entire SPAC industry in the early part of this year, issuing several policy re-interpretations and other commentary that brought new SPAC IPOs to a halt, slowed the approval and closing of existing SPAC merger deals to a crawl, caused virtually all publicly traded companies born from SPACs to restate their financials, and increased the disclosure obligations of all parties involved in the SPAC industry. Just this morning, there’s news of the SEC ramping up its scrutiny of SPACs with a special focus on how the banks often play many sides of the same deal for excess fees (hint: they do).

Concurrently, Gensler has signaled his intent to give crypto similar treatment, although concrete action (beyond a few pointed policy statements) has yet to manifest. He has testified before Congress on the urgent need for increased regulation and has slow-rolled the approval of several applications to create bitcoin ETFs. It has a similar feeling to the weeks before he dropped the hammer on SPACs, at least to this doom-oriented pattern recognizer.

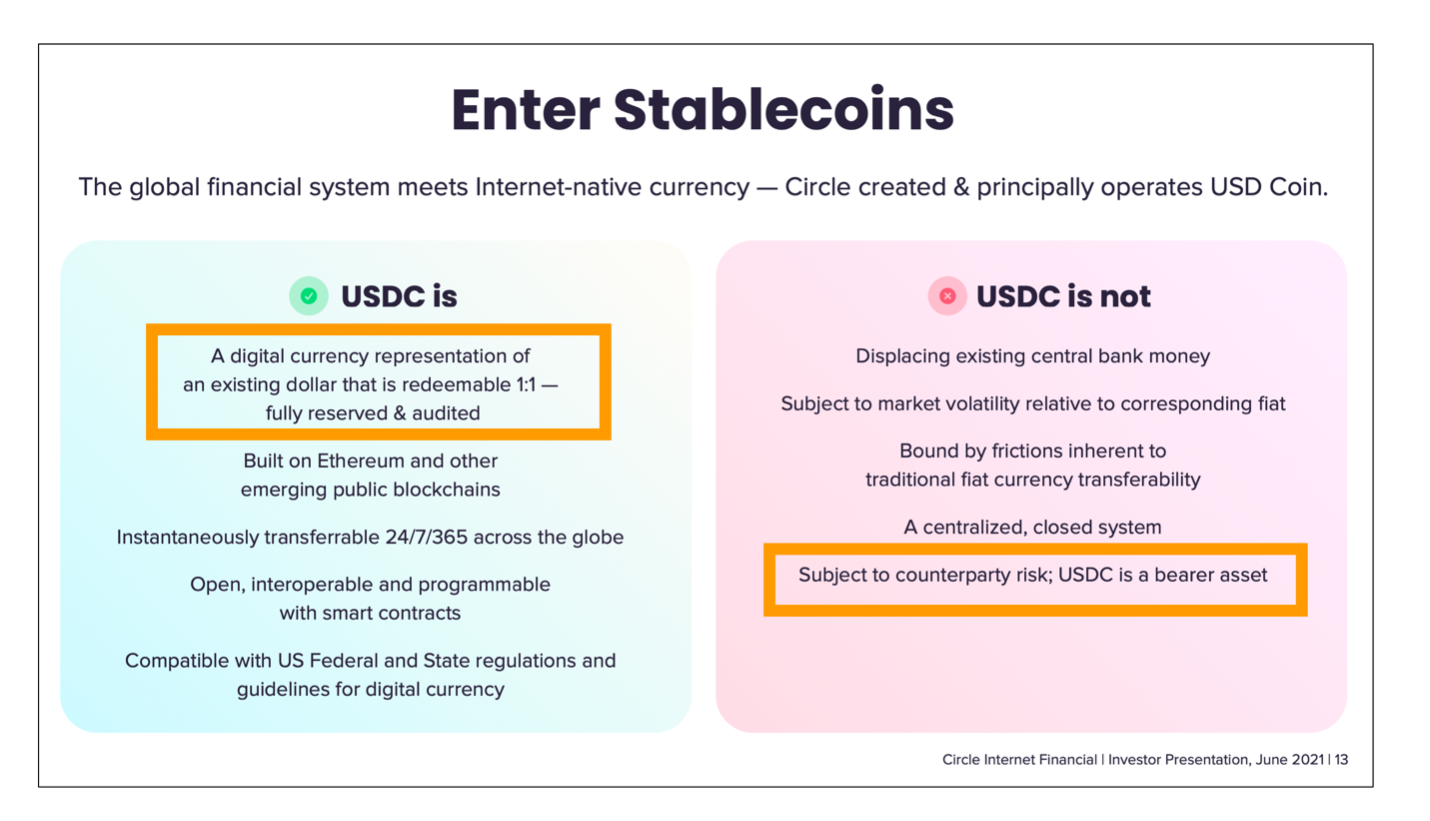

Why, then, would Circle forfeit its current status outside the purview of the SEC by attempting to go public, via a SPAC no less? By combining the two focus areas of Gensler’s SEC, is Circle bluffing? Calling Gensler’s bluff? Buying time? One thing is certain: Circle will have to dramatically increase the accuracy and depth of its disclosures to get this deal through the SEC. In announcing the transaction, the company made some interesting claims. In particular, slide 13 caught my eye:

According to Circle, USDC is “…redeemable 1:1 – fully reserved & audited.” Okay. That’s interesting. All I’ve ever seen are monthly attestations from an auditor, which is completely different than an audit from an auditor. It’s a distinction with an important difference. I guess I missed the full audits of USDC’s reserves, which is what this slide claims have occurred.

Amazingly, the slide also asserts that USDC is not “subject to counterparty risk; USDC is a bearer asset.” I’ve thought about this statement a lot since I first read it and I’ve concluded it is simply false under all possible interpretations. The casual reader of this slide might believe that USDC itself has no counterparty risk, which is obviously false, since even if the reserves were 100% cash held in banks, there’s counterparty risk with those banks. I think they meant to imply that two parties can transact in USDC without counterparty risk with each other. If that’s what Circle meant, they neglected the fact that both parties have counterparty risk with Circle throughout that transaction. In modern finance, there’s essentially no such thing as absence of counterparty risk. It’s a bizarre and misleading claim.

The company also only released its financial performance through December 31, 2020. At that time, the total value of USDC circulating was just over $4 billion. Today, that number is over $26 billion. Nobody is all that interested in what happened with USDC prior to 2021. The focus is on how Circle increased the circulation of USDC six-fold in six months while simultaneously changing (and loosening) its critical disclosures on the reserves backing those issuances.

SPACs got in trouble with Gensler’s SEC for misleading and/or incomplete disclosures, among other issues. I’ve only scratched the surface of this investor deck, but on first blush it is precisely the type of presentation that drew the Gensler’s ire in the first place.

I perceive a coordinated move within the bullish crypto community to cut tether and Bitfinex loose while circling the wagons around Coinbase and USDC. The message will be “sure, everybody knew tether and Bitfinex were frauds, but now we have a good stablecoin and exchange, and everybody should focus on that.” In that context, the move by Circle to attempt to go public makes perfect sense. Long before the SEC adjudicates on this merger, I expect the tether/Bitfinex situation to implode. Regulators will be forced to decide if the entire stablecoin infrastructure will be left to rot, or whether they can minimize the damage to retail investors by overlooking the questions surrounding USDC and letting this deal go through.

My best guess? By trying to force their way public, Circle is bluffing. They are showing up to the Gensler negotiation with a suicide vest on, daring him to risk a full-blown crypto meltdown that damages many US investors and institutions. Feels like they have roughly even odds to pull it off.

If you enjoy Doomberg, subscribe and share a link with your most paranoid friend!

But from the early signs, Gary Gensler is no Jay Clayton. For one thing, they have completely different names. Witty and funny :)

and just a few hours ago:

https://www.sec.gov/news/press-release/2021-124

"SEC Charges SPAC, Sponsor, Merger Target, and CEOs for Misleading Disclosures Ahead of Proposed Business Combination"

this is what we like to see