Battle for the Yen

“But then, if the war continues after that, I have no expectation of success.” – Isoroku Yamamoto

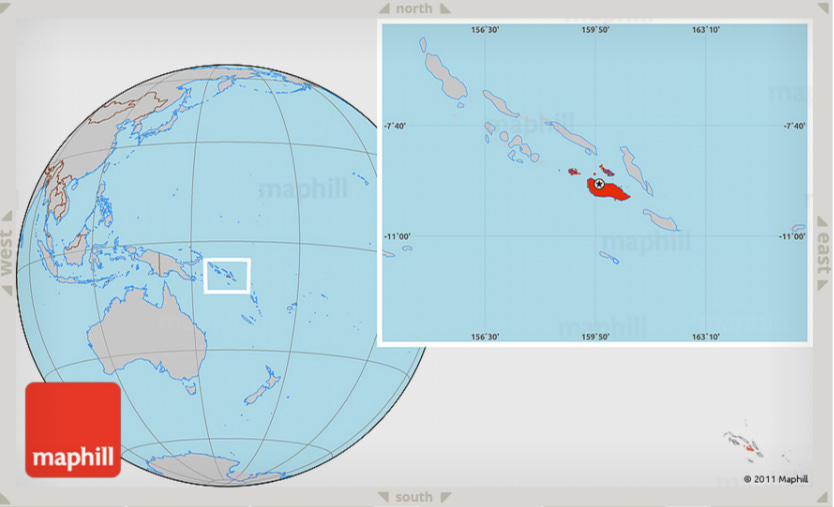

On August 7, 1942, US Marines landed on Japanese-occupied Guadalcanal, the largest of the Solomon Islands by area. Although the US had stunned Japan at sea weeks earlier in the Battle of Midway, the Japanese army had yet to suffer a significant setback on land as it steamrolled across much of Asia and over numerous island outposts in the vast expanses of the Pacific Ocean. Codenamed Operation Watchtower, the invasion of Guadalcanal would become a defining battle of the second world war.

Recognizing the dire consequences a land defeat would entail, the Japanese threw everything they had at the invaders. Over the course of five long months, three major land battles and numerous violent naval engagements were fought on and around the island. The US Navy suffered so many losses during these clashes that the total casualty figures for the campaign were not released until several years after the war. In the end, the US outlasted the Japanese and won a bloody war of attrition. Defeat at Guadalcanal put Japan on its back foot, a position from which it could not recover. The veil of the Japanese Army’s supposed invincibility was lifted and the US went on to convert its enormous energy and industrial advantages into total victory.

We were reminded of this critical battle with the Bank of Japan’s (BOJ) recent attempt to fight off what might be a pivotal turning point in its decades-long brawl against international skepticism of the country’s monetary and fiscal policies. We emphasize “might” because – like the US Navy at Guadalcanal – investors the world over have suffered substantial financial casualties by betting that the Japanese Yen would collapse or that yields on Japanese Government Bonds (JGBs) would skyrocket. Losing money on this seductive trade idea is almost a rite of passage among investors. For further background, we borrow two quotes from Grant Williams in an edition of Things That Make You Go Hmmm… published in June (available by subscription; emphasis added throughout):

“For almost three decades now, investors have looked at the economic headwinds faced by the Bank of Japan, at its QE and QQE policies, and at the country’s awful demographics and realised that the obvious outcome is a massive sell-off in Japanese government bonds (JGBs) and a dramatically weaker yen. So ‘obvious’ has this trade been that, at some point, just about everybody in the financial market has been short either JGBs or the yen — or both.

Of course, the main reason for the failure of the Widowmaker™ trade has been the staunch refusal of the Bank of Japan to ‘allow’ price discovery in JGBs. Over time, its efforts have become increasingly desperate and the distortion of the country’s sovereign bond market more pronounced.”

Could things really be different this time? Has the veil of the BOJ’s invincibility finally been lifted? Let’s dig in.