China Speed

Has the world’s largest oil importer finally unlocked shale?

“Progress lies not in enhancing what is, but in advancing toward what will be.” – Khalil Gibran

As any industrialist who has competed against the Chinese can attest, when conquering a sector is in China’s national interest, significant upheaval usually follows. Using a combination of direct subsidies, aggressive intellectual property theft, lax environmental and labor oversight, and countless other tools, China’s state champions grind away at market share, first in their domestic markets and eventually via exports. They rarely fail to achieve their objectives.

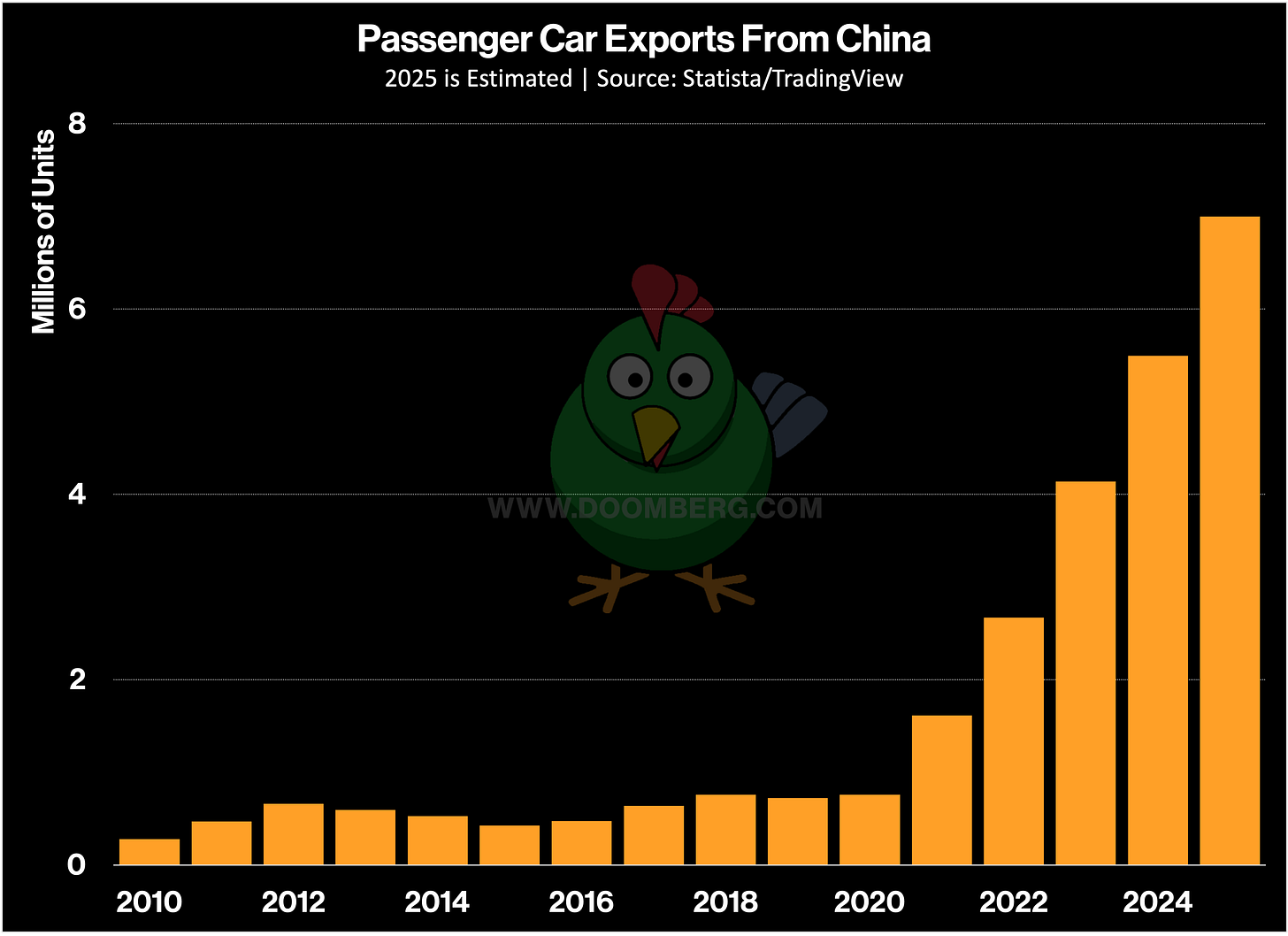

Perhaps nowhere is this more evident than in the automotive sector, where China has transformed itself from a modest player in international markets to a strikingly dominant one today. During a hearing last week of the House Select Committee on Strategic Competition Between the United States and the Chinese Communist Party (CCP), Elaine Dezenski, senior director and head of the Center on Economic and Financial Power at the Foundation for Defense of Democracies, quantified the numbers in her opening statement:

“China dominates the global automotive sector, producing vast numbers of finished vehicles, components, and parts. China produced more than 30 million vehicles last year — nearly triple US output and far greater than the next-largest producers, Japan and India. While the number of finished vehicles imported directly into the United States from China remains modest, the import of Chinese auto parts, components, and materials has ballooned over the last decade. From 2007 to 2018, China’s share of auto parts imported to the United States nearly doubled in quantity – and its value roughly tripled. Moreover, China’s automotive dominance of foreign markets represents an existential threat to US automakers, stealing American market share abroad and diminishing US auto exports.

Chinese companies’ rapid rise and spread throughout global markets is not a story of competitive success, but of non-market manipulations. China’s automotive lead rests on the back of a state-led system that subsidizes overproduction, manipulates inputs and prices, and treats foreign markets as a pressure release valve for its own structural weaknesses.”

China’s aggressive move is partly motivated by the need to transition its domestic car fleet from internal combustion engines to electric vehicles (EVs), especially in its large cities. This serves to reduce local air pollution, an underappreciated factor weighing on China’s leaders, and, more importantly, reduces China’s dependence on foreign sources of oil, a glaring geopolitical weakness the CCP is determined to neutralize. Today, China is the unquestioned leader in both EV and plug-in hybrid electric vehicle sales, and is on track to sell nearly 16 million units across the two categories in its domestic market alone.

China has run up against far greater challenges in unlocking its vast shale resources to address its need for oil and gas. Despite possessing the world’s largest shale gas and third largest shale oil resource base, the country has struggled to overcome technical and geological barriers. This is not for lack of trying, as the CCP continues to direct its national champions to pour huge sums of money each year in pursuit of this top priority.

Because China’s large investments have yielded comparatively disappointing results over the past decade, many Western analysts have all but written off the prospect that the country will ever become a major shale player. However, underestimating China’s potential is almost always serious error. Over the past year, a series of interesting headlines has inspired us to wonder whether the country’s efforts to unlock its shale resources might be nearing a tipping point. If we are right, the energy markets are about to be rocked. Let’s explore why.