Critical Leverage

“It's okay to have your eggs in one basket as long as you control what happens to that basket.” – Elon Musk

Last month, a most unusual presentation was delivered at the Hudson Institute, a conservative think tank that never saw a war it didn’t like. In his prepared remarks and during the extended question-and-answer period that followed, hedge fund manager Kyle Bass made the case that China’s President Xi Jinping was on an “inexorable march toward war” in Taiwan. As evidence, Bass highlighted what Xi was saying and doing internally in contrast with the Western media’s characterization of the situation. Of specific concern to Bass were the readiness simulations undertaken by the People’s Liberation Army, signs of overt preparations for war on the mainland, and certain unusual moves China was making in the global financial markets.

Upon viewing the video, our first instinct was to ponder Ben Hunt’s famous question: Why are we hearing this now? Bass might very well be right, but why is a CNBC regular with a reputation for media savviness teeing up red meat to a room full of self-described neoconservatives with a seemingly insatiable appetite for foreign entanglements of the kinetic variety? More alarmingly, given the tone of the discussion, was anybody in attendance even remotely aware of the extreme economic leverage China has built over the US in recent decades, much of it enabled by Wall Street itself? As we recently argued in “Build Your Dreams,” China has amassed monopolistic control over important choke points in countless supply chains. Here’s how we described their playbook:

“To gain a foothold, the country does the dirty work the West finds unpalatable—in this case, the basic mining, processing, and other ecologically damaging steps. Next, it undercuts international competition until near-monopoly status is achieved in as many foundational steps of the chain as possible. Then, it dangles access to its vast consumer market as leverage to force multinational corporations to relinquish their valuable downstream intellectual property, either directly through the formation of joint ventures (JVs) or indirectly through outright theft, threatening to eject any company from its market that dares to protest too much.”

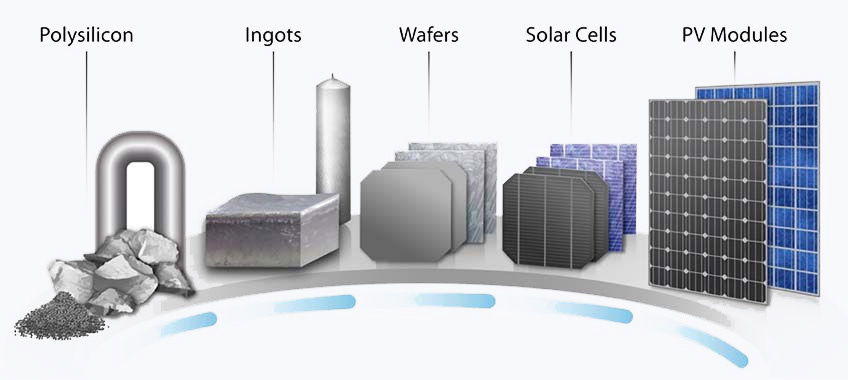

Whether it be sensitive military technology or virtually anything to do with the production and transmission of energy, China has executed its economic strategic intentions with brutal efficiency, leaving the US and its allies woefully disadvantaged should conflict materialize. China used this approach, for example, to dominate several key steps in the production of polysilicon solar cells, by far the most common embodiment of the technology found in the field today (emphasis added throughout):

“As of 2021, China possessed 72% of the world’s polysilicon manufacturing capacity, 98% of ingots, 97% of wafers, 81% of cells, and 77% of modules. Seventy-five percent of the silicon solar cells incorporated into modules installed in the United States are produced by Chinese subsidiaries operating in three Southeast Asian countries: Vietnam, Malaysia, and Thailand.”

With the passage of the Inflation Reduction Act of 2022 (IRA), the Biden administration uncorked a tsunami of spending with the dubious aim of transitioning the US away from fossil fuels. As we have long argued, unless we get serious about manufacturing front-end materials, much of this money will be extracted by China, and its government-supported companies will enjoy windfall profits from our subsidized demand.

Whenever we make this point, astute observers invariably ask about First Solar, the largest solar manufacturer in the US by capacity. Unique among the major players in the industry, First Solar does not rely on the polysilicon value chain but instead uses proprietary cadmium telluride (CdTe) technology to make reasonably efficient and cost-competitive solar cells. The company has become a darling of the environmental left and looks set to be one of the biggest beneficiaries of the IRA. Last week, First Solar announced, “it has selected Louisiana to build its fifth U.S. factory amid a surge in demand for American-made solar panels.” Here’s more from the same Reuters report:

“President Joe Biden's Inflation Reduction Act, a law passed last year that incentivizes homegrown production of clean energy equipment, is underpinning a boom in solar factory investments.

The project is expected to be completed by the first half of 2026 and would add 3.5 gigawatts of manufacturing capacity for the company, First Solar said.

Solar project developers in the U.S. have flocked to First Solar's cadmium telluride products partially because the technology does not rely on polysilicon, a raw material primarily made in China and used in the vast majority of panels.”

This encourages readers, either through intention or ignorance, to believe that because First Solar does not rely on polysilicon, it does not rely on China. Au contraire. Just how “American-made” are CdTe solar panels? Let’s do some digging.