Eggheads

“I've met a lot of hardboiled eggs in my time, but you, you’re twenty minutes.” – Lorraine Minosa, Ace in the Hole

Objectively, being in the egg production business is a tough slog. Producers must bear significant risks, including animal feed cost volatility, disease management, and seasonal variation in demand. In return, they are forced to accept the market price for their product, a number heavily influenced by giant supermarket chains with sophisticated procurement organizations. To make matters worse, the industry undergoes classic boom-bust cycles as producers alternate between over- and under-investing in response to market signals. In other words, the market for eggs is quintessentially commoditized.

In the post-Covid era, there has been a rolling wave of egg shortages around the world, each instance with a unique genesis. In the UK, the ongoing supply squeeze is blamed on skyrocketing feed costs tied to the recent energy crisis, forcing many producers to exit the market. In New Zealand, controversial moves by the country’s two dominant food retailers to impose better chicken-raising conditions have led to significant market disruption. In the US, tens of millions of chickens have been slaughtered to control the outbreak of the H5N1 Bird Flu, leading to a historic spike in the retail price of a dozen eggs:

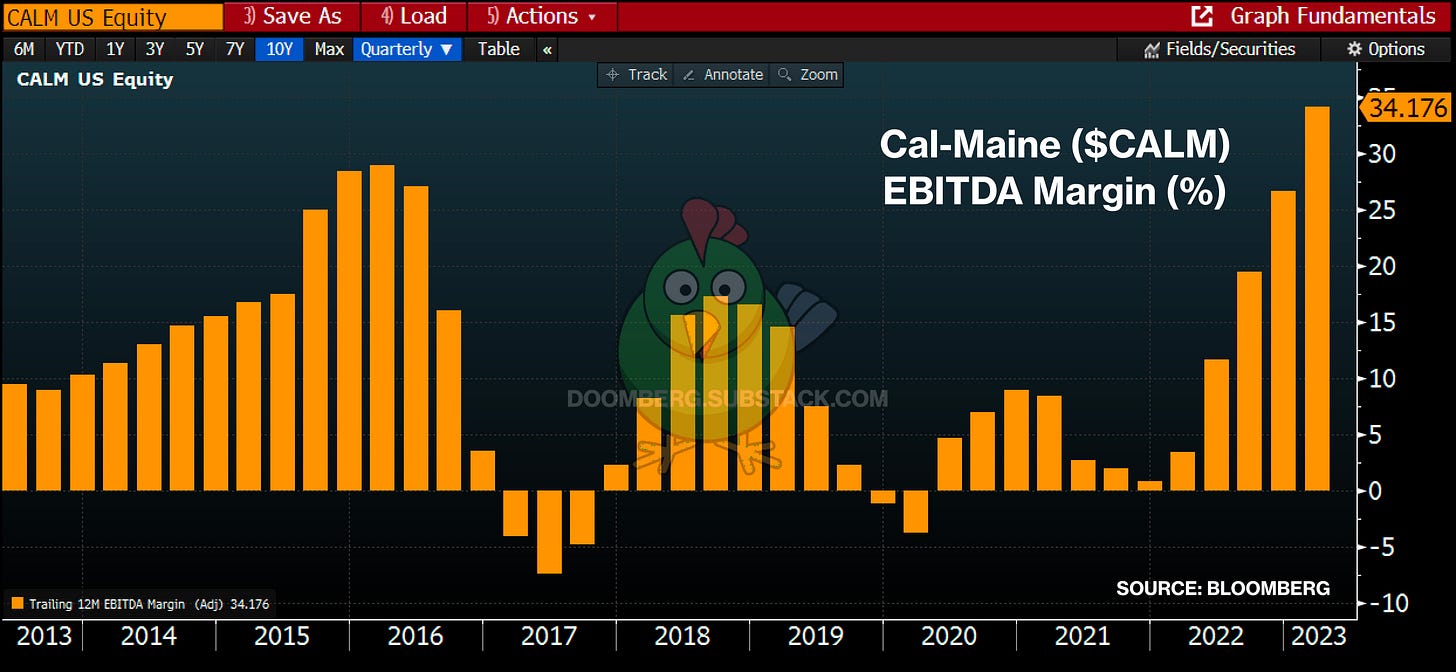

During shortages, commodity producers that overcome industry challenges can (and should) be rewarded for their execution prowess. Elevated prices are the market’s way of signaling it needs more supply, and incentives to meet that demand adjust accordingly. Cal-Maine Foods, the largest egg producer in the US, has demonstrated an outsized ability to supply the market through the pinch, and its performance is reflected in its financials (emphasis added throughout):

“Cal-Maine Foods (CALM), the largest egg producer in the U.S., topped third-quarter earnings views Tuesday, reporting booming profits as a bird flu outbreak decimated chicken flocks and kept egg prices inflated across the country. CALM shares edged down during market trade Tuesday but surged Wednesday.

The Mississippi-based egg producer and supplier has now posted six straight quarters of accelerating earnings growth. CEO Sherman Miller told investors Tuesday the company's Q3 earnings performance reflects increased average selling prices for conventional eggs and strong customer demand.”

In the least surprising political development of 2023, progressive members of the US Senate are irate that somebody somewhere is making money. Senator Bernie Sanders – a lifetime politician with zero experience in productive enterprise – is calling for Cal-Maine to be broken up because they are earning excess returns! Not to be outdone, university-professor-turned-professional-politician Senator Elizabeth Warren took to Twitter to beclown herself on the issue as well:

Easter weekend and green chickens notwithstanding, this is not a piece about eggs. Rather, we take pen to paper here to introduce this strain of erroneous thinking, as it is far from isolated. The politically convenient supply-demand delusion that price-taking commodity producers are somehow capable of price gouging has found a welcome home in the formerly great state of California. Over the past several months, Gavin Newsom has been at war with California's few remaining oil refiners, insisting their gouging is to blame for the state’s sky-high gasoline prices. Newsom and his supporters are intent on learning the truth the hard way. Let’s head to The Golden State and see if we can’t turn a few cracked eggs into an omelet.