Emerging Glut

The US has a propane problem.

“Everything in excess is opposed to nature.” – Hippocrates

Among the family of light hydrocarbons, the simple three-carbon molecule known as propane effectively balances several useful properties. Like all gases, it is somewhat challenging to store, but the temperatures and pressures at which it becomes a liquid are quite manageable. It also burns cleanly, barely less efficiently than its one-carbon cousin, methane (i.e., natural gas). This is partly why you can buy tanks of the stuff at your local hardware store and safely use them around the house to cook burgers on the weekend or to power up backup generators during outages. You can also toss them in the back of your car for that weekend camping trip.

The US is the world’s leading propane producer, with an incredibly sophisticated distribution network to move it from the wellhead to the final customer. After passing through major fractionation and storage hubs, propane transits as a high-pressure liquid via interstate pipelines, railroad tank cars, barges, and coastal or inland tankers. This long-haul system feeds into propane terminals, from which thousands of transport trucks deliver it to distributor bulk plants or depots. Bobtail delivery trucks then carry it to customer tanks.

Because it excels as a direct source of heat, some 5–6 million homes in the US use the fuel to stay warm in the winter. Propane also fuels the large majority of US on-farm grain dryers, with industry and survey data pegging its market share at over 80%. When burned in an engine to do work, propane is somewhat less competitive than diesel, at least as measured on a power-per-Btu basis. However, tailpipe emissions count strongly against diesel, especially in crowded urban or factory settings.

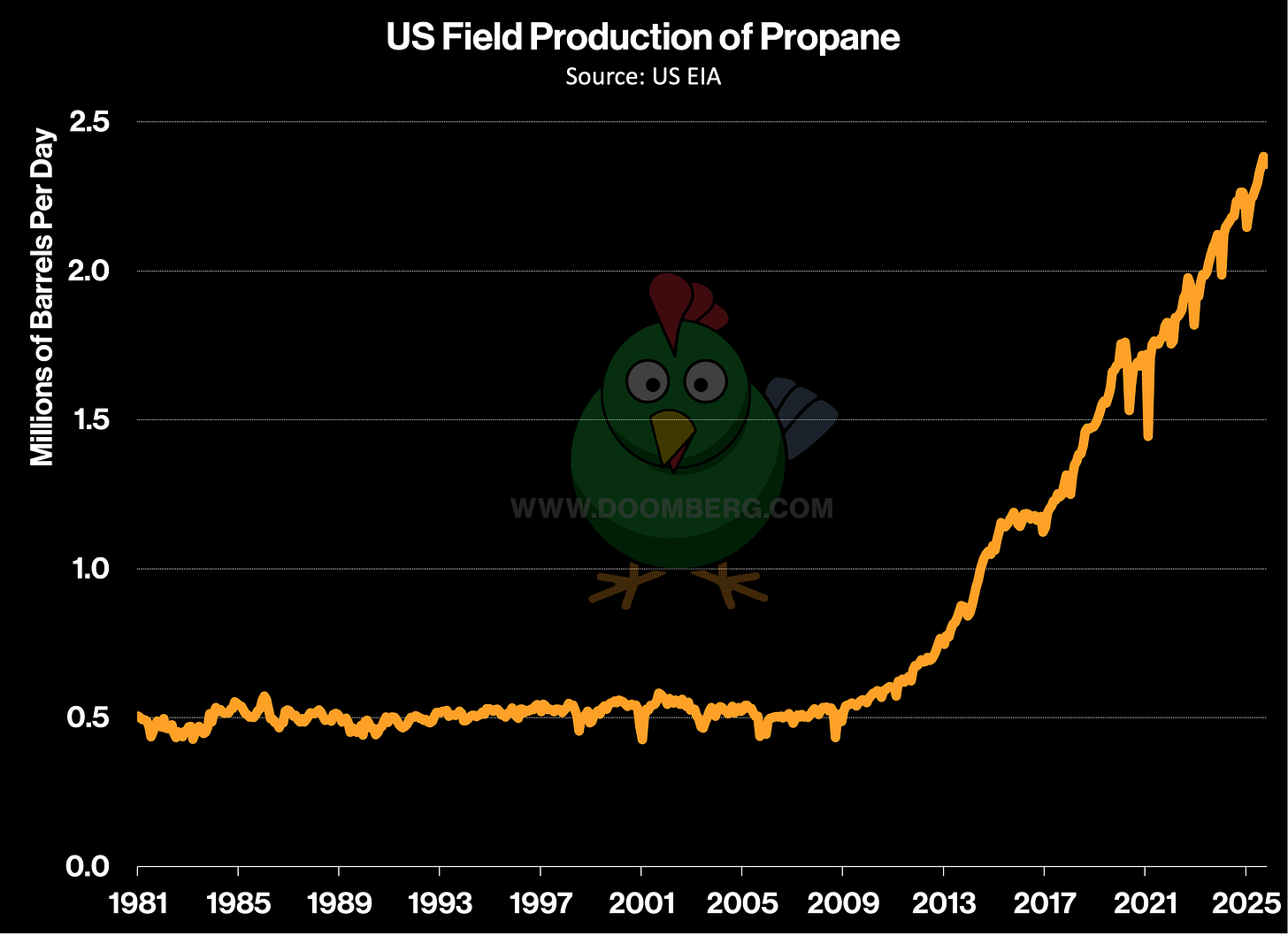

As it’s done to countless others, the shale revolution has utterly upended the propane market. As the second most prevalent component of natural gas liquids (NGLs), production of propane has soared to previously unimaginable heights. From approximately 500,000 barrels per day (bpd) prior to 2010, US field production of propane is rapidly approaching 2.5 million bpd—a nearly fivefold increase in less than two decades.

If propane were produced at the wellhead in isolation, natural market forces long ago would have dictated a slowing pace of growth, as the capacity to handle the increasing deluge is quickly reaching its limits. However, as we have emphasized on several occasions, natural gas, NGLs, and light crude oil are now co-produced from several major shales across the US, especially in the all-important Permian Basin. Such co-production economics can drive wild outcomes, where yesterday’s prized commodities can rapidly become tomorrow’s Tribbles.

This imbalance is a growing potential risk to US energy production, as we suspect two things. First, handling the wave of propane production about to befall US shale regions will be a major story in 2026 and beyond. Second, almost nobody outside the industry is aware of the issue. Let’s quantify the former in an effort to alleviate the latter.