Have Fun Staying Cold

“O, wind, if winter comes, can spring be far behind?” – Percy Bysshe Shelley

As a fuel, natural gas has many compelling attributes. It burns cleanly and efficiently. It produces electricity and useful heat with less CO2 emissions and far fewer toxic byproducts than coal or oil. It is also abundant and ubiquitous. It does have a couple of unfortunate drawbacks, including the fact that it is a fossil fuel (boo!) and that it is a gas at standard temperature and pressure (ugh!). It’s the latter attribute that makes the natural gas market so interesting, although the former plays a significant role in defining the current conundrum.

As brilliantly described by Mark Nelson in this enjoyable episode of the Decouple Podcast (follow Mark’s Twitter here and the Decouple Podcast here), the ability to safely handle and transport gases at extremely high pressures is perhaps the most underrated technological advancement in the history of humankind. The current boom in natural gas use was enabled by a series of booms of the unfortunate variety – vessel construction wasn’t always what it is today.

For a long time, natural gas was a nuisance to the oil driller. It was (and still is, in some parts of the word) vented directly into the atmosphere or flared (i.e., burned) onsite. For these reasons, environmentalists tend to downplay the benefits of natural gas compared to oil and coal. If you add up all the leaks (intentional or accidental), it does chip away at its otherwise remarkable attributes. It is not unusual for a modern US home to have its electricity, heat, and cooking needs all served by natural gas directly. As the owner of one such home, I can attest to the incredible convenience the fuel offers.

To transport natural gas from where it is found to where it is useful, pipelines are a must. The United States has an impressive array of natural gas pipelines that spread across the country like a spider’s web. The US Energy Information Administration (EIA) has a handy mapping tool with details of our entire energy infrastructure. Shown below is the US natural gas pipeline map, including border crossings between Canada to the north and Mexico to the south (marked by the blue and white crosses – more on these later).

Because of the intense need for infrastructure investment to unlock its utility, the natural gas market is highly regionalized and surprisingly heterogenous. Substantial and durable price differences are common between geographies and even within countries. As described in a prior piece, we are endlessly fascinated with such arbitrage situations and how they drive significant innovation. When the same thing sells for different prices in different places, there’s a strong profit motive to close that gap.

As an aside, the sheer intellectual horsepower at companies in the fossil fuel industry is radically underappreciated. The army of scientists, engineers, and technologists at companies like Cheniere Energy, Exxon Mobil, and Saudi Aramco are every bit as talented – and arguably do more important work – than their peers at Apple, Facebook, and Amazon. Without the former, the latter could not exist.

For example, the development and commercialization of liquefied natural gas (LNG) technology is a staggering achievement of engineering. Since building pipelines across oceans isn’t practical, the only way to make natural gas a global commodity is to put it on boats. To accomplish this task, natural gas is processed and chilled to extremely cold temperatures at liquefication facilities, thereby transforming the gas to its liquid state. Here’s how the environmental think tank Sightline Institute describes it:

“Some of the refined gas powers equipment at the facility, while most of it is piped to equipment that cools the gas to -260° F (-162° C). At this temperature, it changes state from gas to liquid, taking up 1/600th of the volume it occupied as a gas. This volume reduction means companies can store or transport the natural gas in much larger quantities.

The equipment used to cool the gas makes up a ‘liquefaction train,’ which has similar components to a household refrigerator. It includes a device where the gas is chilled (called a ‘heat exchanger’ or ‘cold box’), a compressor that chills the refrigerants, and a power source that drives the compressor. The power source is typically a gas or steam turbine, similar to those found in oil refineries, power plants, and large chemical plants. Gas-driven turbines have been standard for over 30 years, largely replacing steam turbines. Some LNG facilities have just one liquefaction train, but most LNG facilities have more than one, producing greater energy demand and higher emissions.

After liquefaction, LNG is stored in a tank that keeps it cold enough to remain in liquid form. Maintaining the cryogenic temperature of LNG consumes a lot of energy, which is why large facilities usually have power generation stations on-site. Liquefaction and power equipment generate the most sizeable share of emissions at an LNG facility.”

Below is a picture of the LNG facility in Sabine Pass, operated by Cheniere Energy. Touring such a facility leaves quite the impression. Installations such as this cost billions to build and require several thousand workers at peak construction.

Once liquified, natural gas is loaded onto enormous and highly specialized cargo ships. By the end of 2020, there were 642 LNG carriers floating around the oceans. Pictured below is the LNG JAMAL, which was built in 2000 and sails under the Japanese flag. Ships like this represent the global flex supply of natural gas, selling their cargo to the highest bidders, often in real time. They are, in effect, floating arbitrageurs. Upon arrival of one of these carriers at an LNG import facility, the reverse process is carried out. The liquid is regasified, pressurized, and sent on via pipeline to the end users.

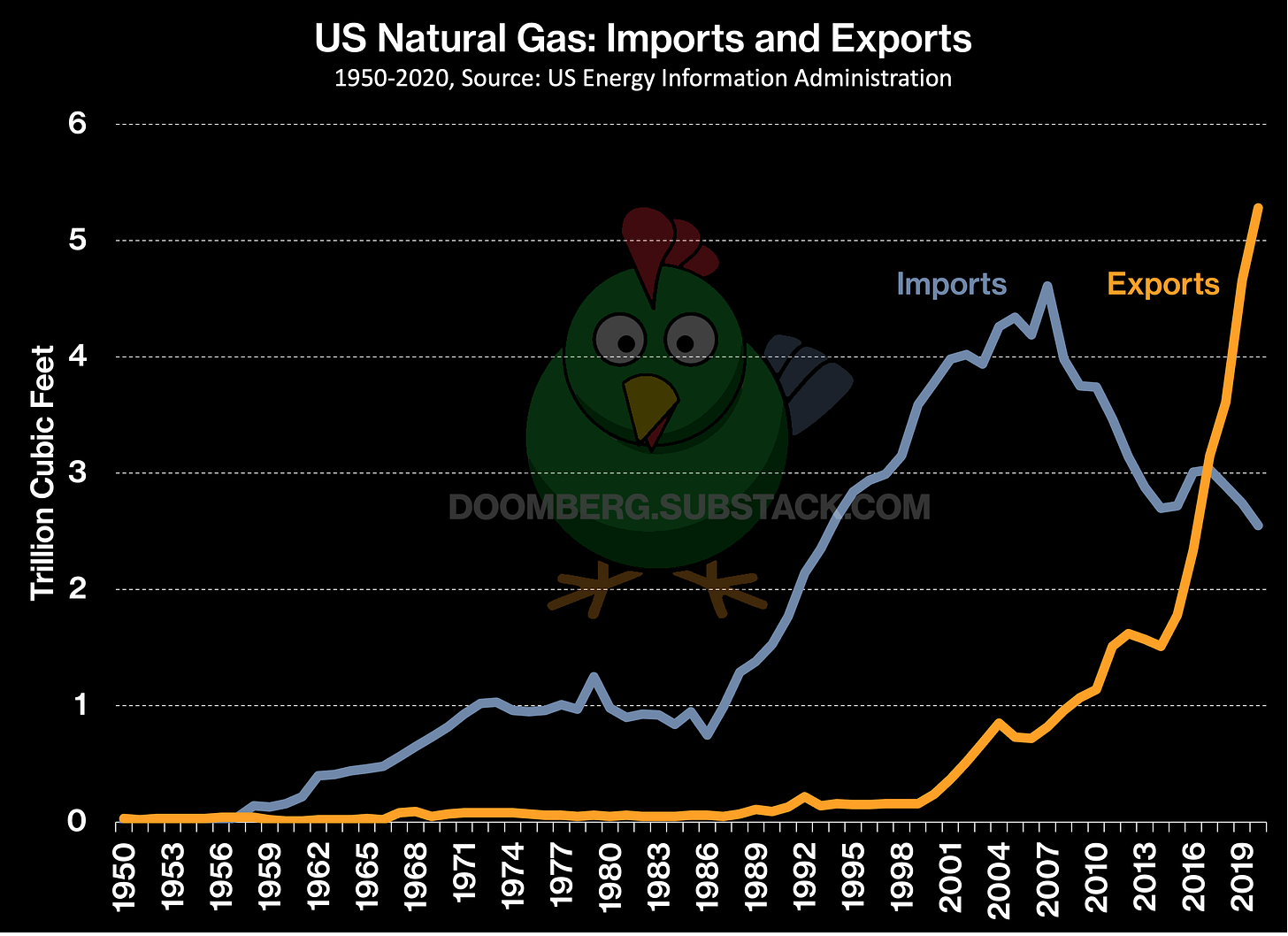

For decades, the US was a net importer of natural gas, predominately from Canada via pipeline. The word “net” is important here because the US also did its fair share of exporting, primarily to Mexico. All this changed with the advent of fracking, which transformed the US into a global energy superpower. The US is once again the largest producer of oil and gas on the planet, and has become the third largest LNG exporter, behind only Qatar and Australia. Absent political intervention by the Biden administration, its LNG exports will soon exceed those countries as well.

With more supply than it knew what to do with, the US saw the price of its natural gas sink to historically low levels relative to the price of oil. Since this gas was trapped in the US, producers could not take advantage of higher prices in the international market. Industry responded by accelerating the build-out of LNG export facilities to close the arbitrage (and, frankly, to enable more production of shale oil as the byproduct, natural gas, had to go somewhere). The US currently exports about 10% of its total natural gas production via LNG, and producers are hoping to double that number in the coming years.

Despite its increasing exports, the US has maintained a stable supply of natural gas to meet its domestic needs. Weekly storage numbers provided by the EIA show the US is largely on track as it prepares for the upcoming winter heating season. As of the last report, dated November 12, the amount of natural gas stored in the US is just 2.2% below the five-year average. The dotted line, set to the current year’s peak inventory level, is well within a safe and stable range of prior crests heading into peak demand.

By now we all know Europe is a decidedly different story. Through a combination of poor planning, scientific illiteracy, and economic arrogance, the EU finds itself entering peak heating season with criminally low levels of natural gas in storage. The chart below tells the story – this year’s max inventory falls well below any in recent history.

Historically, Japan is the leading importer of LNG, but China is not that far behind. Together, they account for roughly half of all LNG imports in normal years. They say it only takes two bidders to make an auction, and China’s Xi Jinping – no doubt watching the unfolding humanitarian crisis in Europe – is hammering the ask by ordering state-owned companies to literally pay any price to assure supply:

“China has ordered state-owned energy companies ‘to do whatever it takes’ to secure fuel supplies, putting further pressure on the price of gas paid by already struggling UK energy suppliers.

The vice-premier, Han Zheng, told China’s energy companies to make sure there is enough fuel to keep the country running as Beijing battles to manage a power crisis that threatens to hit growth in the world’s second-biggest economy.”

With Europe in desperate need for natural gas and Xi willing to outbid them for every increment of LNG supply no matter the cost, jaw-dropping prices have materialized. We’ve published many charts here at Doomberg, but this one is perhaps the most stunning. Below is the benchmark natural gas price in Asia (JKM), Europe (Dutch TTF) and the US, all expressed in US dollars per million BTUs. Staggering does not begin to describe the consequences of what is currently playing out.

The price of natural gas in Asia and Europe is roughly seven times what consumers are paying in the US. Naturally, with Xi loudly announcing a “Europe plus whatever/no matter what” bidding strategy, LNG exporters are directing their fleets to set sail to Asia, and Europe will be left to beg Russia to fill the gap. Here’s how Qatar’s energy minister frames the delightful situation he finds himself in (emphasis added through this piece):

“The Qatari Energy Minister, Saad Al-Kaabi stated, ‘we have huge demand from all our customers and unfortunately, we can’t cater for everyone.’ Qatar prefers East Asian customers who pay a premium. The EU is no longer the top market. This trend is consistent with exporters around the globe. Coupled with a decrease in domestic production, such as the depletion of the giant Groningen gas field in the Netherlands, the EU is left to bid higher and higher for imports. This coincides with overall uptick in demand for LNG across the globe in an effort to use it as a bridging fuel away from hydrocarbons.”

For his part, Vladimir Putin – the quintessential cat that ate the energy canary – finds himself holding all the cards in Europe. Yesterday, Grant Williams published the November edition of Things That Make You Go Hmmm… to his Silver and Gold subscribers. Brilliantly titled Putin on the Ritz, it is a reminder of why subscribing to Grant’s stuff is worth every penny. In the piece, he quotes Putin from a recent three-hour Q&A given in October. Here, Putin provides his point of view on the origins of the unfolding energy crisis in Europe:

“First, a decline in production in the gas producing countries. Production in Europe fell by 22.5 billion cubic metres during the first six months. This is first. Second, gas storage facilities were underfilled by 18.5 billion cubic metres and are only 71 percent full. The gas storage facilities were underfilled by 18.5 during the first six months of the year. If you look at annual consumption, this number must be doubled.

Primarily American, along with Middle Eastern companies withdrew 9 billion cubic metres from the European market and redirected the gas to Latin America and Asia. By the way, when the Europeans were formulating the principles governing the formation of the gas market in Europe, and said that all gas must be traded on the spot market, they were proceeding from the assumption that the European market is a premium market. But the European market is no longer a premium market, you see? It is no longer a premium market. Gas was redirected to Latin America and Asia.

I have already said that 18.5 billion cubic metres, plus double that amount, 9 billion (undersupplied to the European market from the United States and the Middle East), plus a decline in production of 22.5 billion – the deficit on the European market may amount to about 70 billion cubic metres, which is a lot. What does Russia have to do with it? This is the result of the European Commission’s economic policy. Russia has nothing to do with it.”

Putin is correctly pointing out that the US and Qatar have sold their LNG to the highest bidder, and the highest bidder isn’t Europe. That leaves Europe with no other choice but to beg Putin for more supply – or so we thought. Here’s how we framed Europe’s choices in an earlier piece called Putin’s Fools Rush In:

“The prize Putin will soon collect is the inevitable go-ahead by Germany to begin operating the Nord Stream 2 pipeline, an act that will decisively and irreversibly conclude a years-long struggle between the United States and Russia in Putin’s favor.”

We could not have been more wrong. Like a poker player facing pocket aces while holding seven-deuce off suit, Germany should have folded once Russia went all in. Instead, Germany decided to pretend like it still had some power in this situation:

“Germany has suspended its approval process for the controversial Nord Stream 2 gas pipeline which would double its reliance on Russian gas following growing geopolitical pressure to scrap the project.

Energy markets across Europe surged after the German energy regulator suspended its certification process, in a big setback to Kremlin-backed Gazprom’s plans to extend Russian gas dominance via a new pipeline across the Baltic Sea.”

Further down in the same story, we discover even more insanity:

“Germany’s decision to delay Nord Stream 2, which bypasses current pipelines that run through Russia’s nearest neighbours in Ukraine and Belarus, follows calls from western leaders to scrap the plan or risk destabilising the region.

Boris Johnson warned Germany that it would have to choose between ‘mainlining ever more Russian hydrocarbons in giant new pipelines’ and ‘sticking up for Ukraine’ and ‘championing the cause for peace and stability’ in eastern Europe.”

In the final days of World War II, a thoroughly defeated Hitler was reduced to demanding that his generals move non-existent armies to the Eastern Front. Here, Johnson might as well be doing the same with natural gas supplies. Where does the good Prime Minister suggest the people of Europe find its much needed supply? We think the response from Putin will be clear.

Have fun staying cold.

If you enjoy Doomberg, subscribe and share a link with your most paranoid friend!

There's something to be said about Russia's ability to use winter to its geopolitical advantage. Even though there is plenty of historical evidence of their strategy, Russia's foes (political / economic / military) always seem to ignore the weather. Remarkable.

This one knocked it out of the park! One of the best Doomies I've read yet.