How OPEC Ends

Marking the inevitable demise of the world’s most important cartel.

“We don't have a monopoly. We have market share. There's a difference.” – Steve Ballmer

On November 27, 2014, the Organization of the Petroleum Exporting Countries (OPEC) gathered in Vienna, Austria, for one of its regular meetings. The outcome of this one would prove momentous. Although Brent crude had traded comfortably above $100 a barrel for most of the prior few years, a booming US shale sector had caused prices to dip to the high $70s as attendees arrived. Led by Saudi Arabia, OPEC made the fateful decision to engage in a price war with American producers, a move that shocked market observers:

“The stated belief from some OPEC members at that time was that this would cause a dip in oil prices, and that would put a lot of the marginal shale oil producers out of business. Instead, oil prices plummeted, some shale oil producers went out of business, but the strategy indeed cost OPEC at least a trillion dollars of lost revenue as most shale producers held on.

In late 2016 the cartel waved the white flag, abandoning this strategy and returning to making production cuts to boost prices. That strategy persists to this day.”

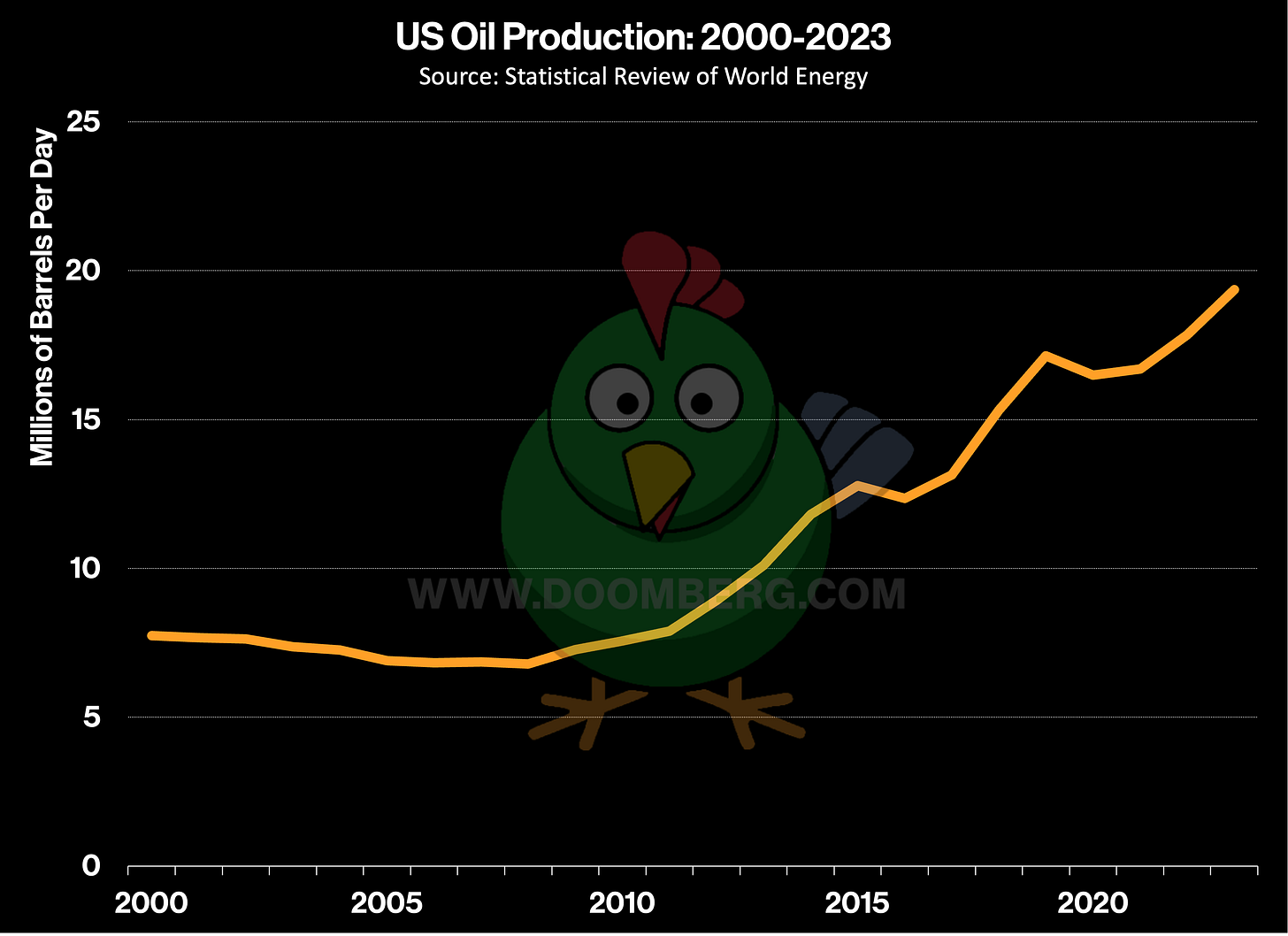

OPEC grossly underestimated both the willingness and the capacity of US shale companies to incinerate shareholder capital in the name of growth. Even as oil prices ground lower—eventually bottoming out in the upper-$20s in January of 2016, well below the estimated marginal cost of production for most shale upstarts—US production climbed inexorably higher. The few companies that did file for bankruptcy either kept producing or sold assets to others that could, using the courts as a shield to recapitalize in the hopes of exploiting firmer prices in the future.

Recognizing its defeat, OPEC engineered an unusual expansion in December of 2016. A deal was signed that brought Russia and a few other large producers to the table and created what is now informally known as OPEC+. The new participants chose not to become full members of OPEC, giving them flexibility in domestic industry management, but they agreed to collaborate with the cartel to stabilize prices—an arrangement that worked well enough until Covid-19 hit. During the chaos of the outbreak, relations between Saudi Arabia and Russia temporarily crumbled, and a short but violent price war broke out:

“Saudi Arabia, with its allies in the Organization of Petroleum Exporting Countries (OPEC), proposed a production cut in early March 2020 in order to stabilize crude oil markets. However, this action was met by a challenge from Russia – an oil giant outside the OPEC – whereby it would increase its production and supply. Saudi Arabia responded with an increase in oil production and Russia retaliated in the same way, which resulted in the oil price war. Through broad international political mediation and intervention, Russia and Saudi Arabia finally reached a cut agreement in April 2020. The oil price war and the pandemic severely damaged crude oil markets, which put huge downward pressure on prices and negatively affected the welfare of oil producers.”

OPEC was clearly on the ropes when the outbreak of war in Ukraine disrupted the geopolitical landscape, handing the cartel an incidental reprieve. Oil prices skyrocketed—always a good cure for the group’s ailments—and Russia’s stance became more pliable in the face of the West’s attempt to isolate the country. In particular, the sanctioning of Russia’s foreign exchange reserves shocked Saudi Arabia and other oil exporters, and Russia developed stronger ties with major oil importers like China and India. The latter were happy to receive discounted Russian crude, predictably defying the Biden administration in the process. OPEC+’s newfound unity forced Biden to drain half of his country’s strategic petroleum reserve to bring prices back under control.

With the war in Ukraine flaming hotter and the Middle East on the brink of widespread conflict, now might seem an unusual time to highlight the risk of OPEC’s potential decline. In our view, events on the ground in various resource-intense countries are converging with the hydrocarbon markets to create an existential threat to the cartel’s continued influence. In a timeframe measured in just a few years, OPEC’s nearly 65-year stranglehold over global oil prices might finally reach its end. Let’s drill into the rationale.