“The elephant in the room is whether you’re going to be renominated. Renominating you means gambling that, for the next five years, a Republican majority at the Federal Reserve, with a Republican chair who has regularly voted to deregulate Wall Street, won’t drive this economy over a financial cliff again.” – Elizabeth Warren (emphasis added)

It’s no coincidence that Senator Warren led her barrage against Jerome Powell with an elephant – the elephant being the mascot of the other team, after all. In doing so, Warren has made clear her decision to make Powell’s potential renomination as Chair of the Federal Reserve yet another partisan battle. Jerome Powell is now an elephant, and we predict he will be donkey-kicked to the curb of history in short order.

The United States is an endlessly fascinating place to observe the rawness of power. When it became clear that the judiciary could be gamed to make it the most equal among the three equal branches of government, the appointment and confirmation of federal judges transformed from a sleepy afterthought that routinely sailed through the US Senate by unanimous consent into a hyper-partisan affair. Supreme Court nominations have dissolved into nuclear wars between the parties, with all manner of brass-knuckle political tactics considered fair game.

It wasn’t always this way. Ultra-conservative Antonin Scalia was confirmed to the Supreme Court by a Senate vote of 98-0, as was John Paul Stevens. Sandra Day O’Connor outdid them both with a vote of 99-0.

And then Bork became a verb.

When President Ronald Reagan nominated Robert Bork to the Supreme Court in 1987, none other than current President Joe Biden presided over his nomination in the Senate, and Biden’s behavior changed history forever. Here’s how The Hill described it in an opinion piece published in 2020:

“As head of the Senate Judiciary Committee, he presided over the infamous Robert Bork hearings. His smearing of Bork for his original-intent judicial philosophy transformed hearings for Supreme Court nominees into bloody ideological battles. Henceforth, all conservative nominees were subjected to “Borking.”

Brutal to Bork from the start, Biden treated him not as a serious judge but as a stooge for what Biden called the “Reagan-Meese” agenda…

Biden considers his defeat of Bork one of the most glorious moments of his career. But for the Republic, it marked one of the lowest. It further cemented the groundwork for a politicized judiciary which has taken decisions out of the hands of the people and placed them in the hands of nine lawyers. It undermined the integrity of the confirmation process.”

With that backdrop, consider the following question. Who has more power in the US today – a Supreme Court justice, the Vice President, a US Senator, or the Chair of the Federal Reserve? The answer is as obvious as it is an indictment of US fiscal and monetary policy over the past few decades. The Supreme Court printer doesn’t go BRRR…. Vice President Harris can’t rescue the stock market with a press release. The typical US Senator struggles to stay awake during roll call.

Jerome Powell has all the power, and his time on the throne is limited. The Federal Reserve was originally designed to have maximum independence, but it has accumulated enough political influence that the Fed Chair is probably the second-most powerful person in the country. The days of objectively analyzing the actual performance of the person in the job when considering renomination are over, and Powell shares much of the blame.

Although the Fed was becoming more politicized before Powell became chair, he erased whatever independence remained when he acquiesced to President Trump’s relentless and often disrespectful demands for looser policy. Trump was obsessed with the stock market, viewing it as an important measure of his competency. Frustrated by the disparity between US and European interest rates, Trump openly mocked Powell on Twitter, demanded he “do more” to help the economy, and blamed him when the stock market wobbled.

This was a dangerous red line for any President to cross, and if Powell had any personal dignity or concern for his institution he would have resigned. The ensuing chaos in global markets would have taught Trump (and future Presidents) the value of an independent Fed Chair.

Instead, Powell folded.

In Let Them Eat Pizza, we raged against Robert Kaplan, soon-to-be former President and CEO of the Federal Reserve Bank of Dallas. The piece touched a nerve, garnering 24,000 views in just a few days. While the insider trading scandal at the Fed continues to mushroom, expanding just yesterday to Fed Vice Chair Richard Clarida, we think the Kaplan scandal has a lot more legs.

According to Wall Street on Parade, the Dallas Fed refuses to release precise details of Kaplan’s trades, including the dates he bought and sold, as well as whether he ever shorted the market. Wall Street on Parade would like to match the timing of Kaplan’s trades with his numerous media appearances, some of which were incendiary and moved markets. That the Dallas Fed is slow rolling the release of these details tells you all you need to know about what they show. This information belongs to the public, and it will eventually come out. Get ready for the worst.

In 3,170 miles, we discussed bank runs – both literal and figurative. The speed with which such runs occur continues to surprise people. Elizabeth Warren is a thorn in the side of many on Wall Street. You might not agree with her politics, but she is smart, tough, and knows how the political game is played. She knows a good wedge when she sees one and understands the value of a high-profile political scalp. In contrast, Powell and the other members of the Fed are political rookies, new to the game they inadvertently invited themselves into. They are no match for the likes of Warren.

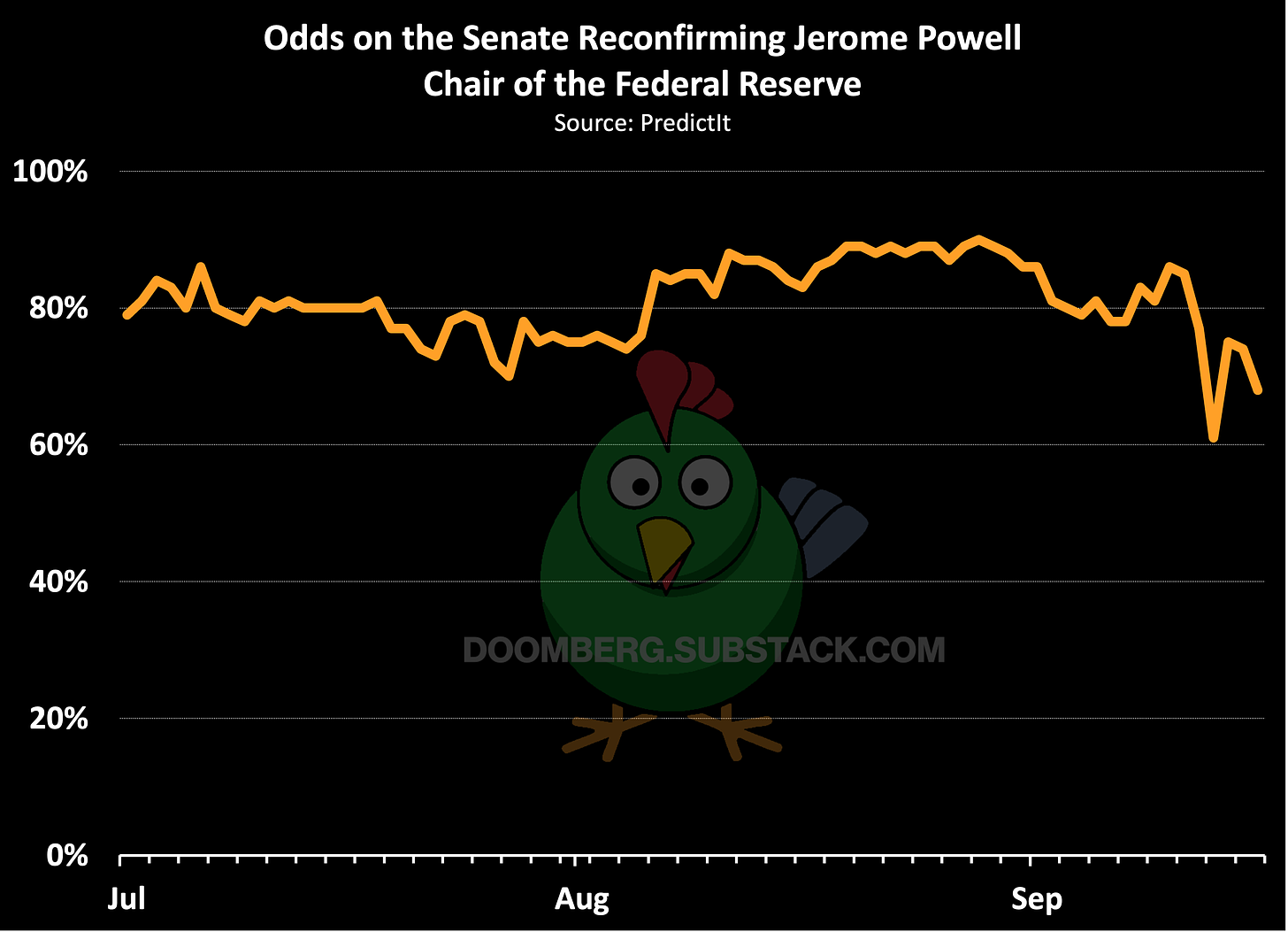

The insider trading scandal at the Fed is going to trigger a bank run on Powell’s political prospects. Already, the prediction markets are starting to sniff this out. The chart below from PredictIt shows the betting odds that Powell gets another term. We don’t give investment advice here at Doomberg, nor are we experts in technical analysis, but that chart sure doesn’t look healthy to us. And for good reason.

Powell is going to get Borked.

If you enjoy Doomberg, subscribe and share a link with your most paranoid friend!

It is ALL about preserving the stock market. Nothing else matters. I am looking at you Jerome Powell.

"They" don't want taper, they don't want higher rates... they want MMT. Remove Powell and replace with your own guy/girl.