Last in Line

“It takes as much energy to wish as it does to plan.” – Eleanor Roosevelt

In late 2019, several pension funds, insurers, and large companies penned an open letter to Dr. Fatih Birol, head of the International Energy Agency (IEA), urging him to do more on climate change. Formed in the aftermath of the 1973 oil embargo, the IEA’s original mission was to provide data and statistics on the oil market, promote energy conservation, and coordinate the use of global strategic oil reserves by its member countries.

The letter urged Birol to refocus the IEA’s iconic World Energy Outlook – published annually and considered an indispensable statistical resource for industry participants – into an advocacy arm of the decarbonization agenda. Here’s how Reuters described it (emphasis added throughout):

“Since the start of this year, various networks of institutional investors, asset owners, scientists and climate advocacy groups have been urging Birol to change the way the report is produced and presented.

These critics argue that a revised approach could unlock faster investment in renewables and better identify possible risks to the value of oil, gas and coal companies posed by the prospect of rapid action to cut greenhouse gas emissions.”

In May of 2021, Birol over-delivered by publishing an entire “flagship report” titled Net Zero by 2050: A Roadmap for the Global Energy Sector. While the flashy document is filled with charts meant to give the impression of intellectual gravity, its contents are categorically hand-wavy gibberish. The report promotes optimistic projections about what is “possible” based on their “pathway,” but is notably light on real-world constraints, tradeoffs, and risks to humanity should their path be taken. In the 24-page executive summary of the report, we find these dangerously unserious words:

“Beyond projects already committed as of 2021, there are no new oil and gas fields approved for development in our pathway, and no new coal mines or mine extensions are required. The unwavering policy focus on climate change in the net zero pathway results in a sharp decline in fossil fuel demand, meaning that the focus for oil and gas producers switches entirely to output – and emissions reductions – from the operation of existing assets. Unabated coal demand declines by 98% to just less than 1% of total energy use in 2050.”

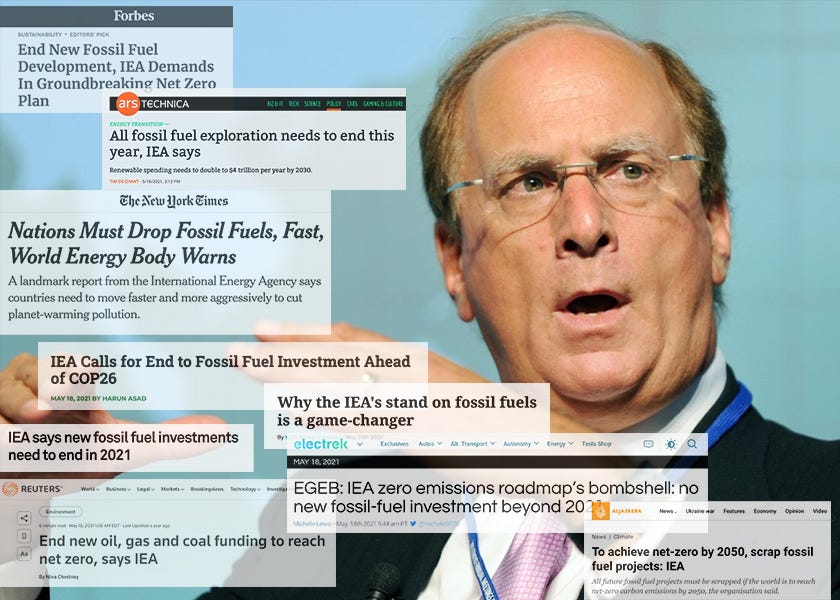

The resulting media frenzy was epic. Headlines across the spectrum heralded the IEA’s calls for an immediate freeze of all fossil fuel investments, empowering energy know-nothings (like Blackrock’s CEO Larry Fink) to speak with a little more confidence than his expertise would otherwise justify while wielding disproportionate influence over the funding of our collective energy future. “It’s not just me saying it – look at this authoritative study from the experts at the International Energy Agency!”

The great irony is that this flagship report was issued just as the European energy crisis was beginning to unfold, and it has been proven so wrong so quickly one wonders why they have kept it posted on their website. While many attribute the current global predicament to Putin’s invasion of Ukraine, that event only exacerbated a crisis that can claim its genesis in early 2021. At that time, European countries (Achtung, Germany) – undoubtedly sanctioned by the same thinking that led to the production of the IEA’s regrettable document – blundered by not producing enough of their own energy while simultaneously failing to acquire sufficient natural gas in time for the winter of 2021-2022.

With fall upon us and the next winter now approaching, the primary economic and humanitarian impacts of Europe’s naïve intoxication of energy impossibilities are now inevitable. The fallout for the average European citizen remains to be seen, but today we turn our attention to the second-order effects of Europe’s historic divorce from reality: the unavoidable and crushing impact on emerging economies.

The early signs are dire. Let’s dig in.