Late Britain

A decisive moment approaches for the United Kingdom.

“It is in your moments of decision that your destiny is shaped.” – Tony Robbins

In June, Prax Group, a UK energy conglomerate and fuel supplier, fell into insolvency. It didn’t take long for British authorities to uncover what appears to be significant fraud in the company’s £780 million receivables securitization facility. A “large hole” of cash is missing, leaving creditors to scramble for what residual value remains. In a statement to Prax’s administrators, former CEO Winston Soosaipillai dryly claimed, “I am without the direct knowledge necessary to concur with the outstanding balances owed to creditors.”

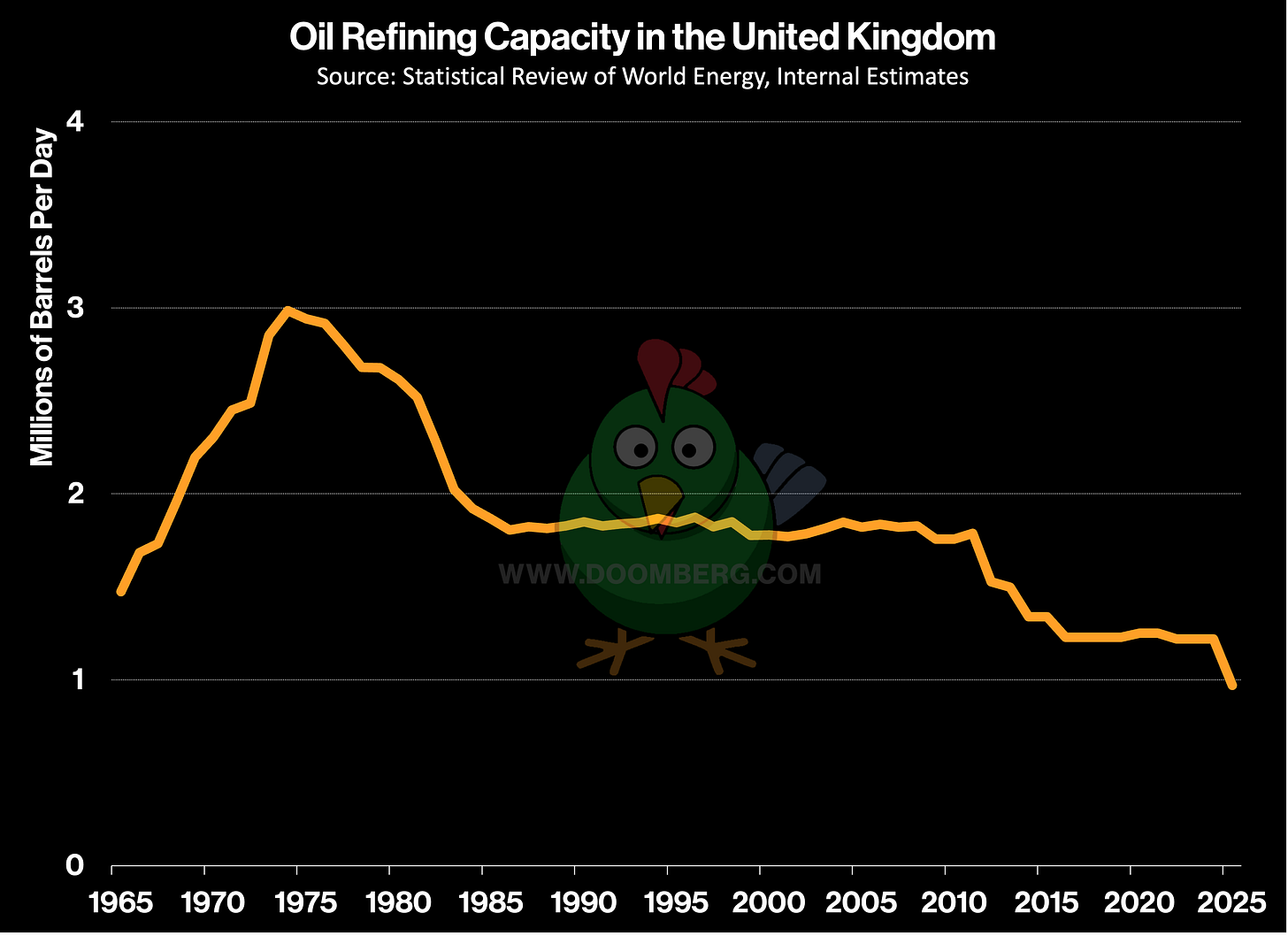

Our interest in Prax arises from the fact that the company operated the Lindsey Oil Refinery in North Killingholme, England. At the time of the filing, it was one of only five operating across the entire UK. The refinery has since ceased operations, and no bidder has emerged with a plan to reopen it—the country is now down to just four:

An underappreciated consequence of regulatory hostility toward the oil and gas sector is that it often triggers a decay in the ownership quality of critical energy infrastructure. Large, well-capitalized supermajors head for the exits, leaving firms with thinner track records and shakier balance sheets to grapple with the quagmire. The Lindsey refinery was originally built by a joint venture of TotalEnergies and Fina in 1968, and the former took full possession of the facility in 1999. After two decades of struggles, Total finally sold the facility to Prax in 2021 for a mere $167 million.

A similar situation appears to be unfolding on the gas side of the British energy ledger, where Shell and ExxonMobil are actively trying to sell several jointly owned North Sea gas fields and the strategically important Bacton gas terminal. The planned buyer is Viaro Energy, an upstart company with a controversial founder. Francesco Mazzagatti is a 39-year-old Italian energy entrepreneur currently facing several criminal and civil charges of malfeasance. According to The Telegraph:

“These include allegations in London’s High Court that he embezzled €143m (£125m) from Singapore-based Alliance Petrochemicals Investment. He says the case is part of a vexatious, multi-jurisdictional smear campaign and that he has secured victories in related cases in the UAE and Singapore.

He is also accused of bribery and money laundering in a criminal trial in Milan. Again, Mazzagatti denies wrongdoing and the case continues. Separately, in Rome, Mazzagatti stands accused by the Italian tax authority of fraud and accounting irregularities. He says that he has not been formally notified of any case but concedes there is a ‘pending administrative dispute,’ in which he denies wrongdoing.”

Although the Californication of the British energy regulatory regime has been decades in the making, it reached its zenith in May of 2022, when Chancellor of the Exchequer Rishi Sunak introduced a windfall profits tax on oil and gas companies. Ostensibly, the move was in response to soaring energy prices and was originally set to expire in 2025. Instead, the Energy Profits Levy (EPL) has been raised twice and extended to 2030, leaving energy companies facing a stifling 78% marginal tax rate. It’s no wonder the stampede for the exits has been disorderly.

With Britain’s fiscal situation deteriorating quickly, current Chancellor Rachel Reeves faces the ominous task of proposing a credible plan when she releases her Autumn Budget on November 26. The devastating consequences of the EPL on investor mindset—to say nothing of its direct impact on Britain’s energy security—are plain for all to see, but cutting taxes into the teeth of a funding crisis might rejuvenate the head-of-lettuce meme that befell former Prime Minister Liz Truss. In late October, the Financial Times published a classic trial balloon about her thinking:

“Chancellor Rachel Reeves could scrap a windfall profits levy on the UK oil and gas industry sooner than expected, after Prime Minister Keir Starmer said he wanted to ‘double down’ on North Sea extraction.

Reeves is considering using her Budget to end the energy profits levy in March 2029—reversing a decision in last October’s Budget to extend it by a year to March 2030—according to people briefed on her thinking.

But the chancellor, under fierce fiscal pressure in her Budget, is seeking assurances from oil and gas companies that the move would result in new investment and jobs, and ultimately more tax revenues for the exchequer.”

An arch-opponent of any EPL change favoring hydrocarbon development is Ed Miliband, the ringleader of Britain’s circus of incompetence and current Secretary of State for Energy Security and Net Zero. That the country’s heavy industry leaders are practically begging Reeves for relief is of little concern to Miliband:

“More than 110 companies have signed a letter calling on the government to end the Energy Profits Levy (EPL) on North Sea oil and gas firms. At the same time, energy secretary Ed Miliband has given a speech at Energy UK conference 2025 signalling his desire to move away from fossil fuel production…

Offshore Energies UK (OEUK) posted the letter on its website stating it had been signed by 110 signees, whose names have not been disclosed. Offshore Energies has warned the government that ‘without a permanent replacement for the temporary Energy Profits Levy, the nation risks losing thousands more jobs, billions in investment and critical supply chain capability essential for the UK’s energy security and transition.’”

Far from concerning himself with the well-being of average British citizens, Miliband recently jetted nearly 4,600 miles from London to Belém, Brazil, to attend the 30th session of the Conference of the Parties (COP30) to the United Nations Framework Convention on Climate Change, burning copious amounts of jet fuel along the way. Joining Miliband at the junket was “never here” Keir Starmer, currently the least popular British prime minister in the country’s history.

However unpopular Starmer, Miliband, and Reeves may be, Britons are likely stuck with the Labour Party until July 2029. Because of Britain’s first-past-the-post electoral system, Labour parlayed less than 34% of the popular vote in the 2024 election into 63% of the seats in the House of Commons, a historic majority. By comparison, France’s Marine Le Pen saw her National Rally party receive 32% of the vote days after the British went to the polls, but was awarded just 22% of the seats in the National Assembly. Le Pen is also currently under house arrest.

Starmer’s unpopularity has led some to speculate that he might be ousted by his own party in a leadership shakeup. Such a development would likely bring little relief to British industry, as the person most likely to win the internal Labour Party race to replace him is none other than Miliband himself:

“If that happens, how would Miliband be positioned in the subsequent leadership contest?

The answer would seem to be ‘extraordinarily well’. According to LabourList’s Cabinet League Table, Miliband is by a clear margin the most popular minister with Labour members: in the most recent poll his lead over John Healey, the second-most popular, stood at over 30 points.

Historically, this might not have mattered so much because the membership commanded only one third of the vote, alongside the MPs and trades unions, in the electoral college. But that system was scrapped in 2015 – by none other than the then leader, one Ed Miliband – in favour of ‘one member, one vote.’”

This is the political backdrop against which Reeves will soon decide the fate of the EPL and, with it, what’s left of British heavy industry. If she flubs the Autumn Budget, Britain could be thrown into a bond-market crisis like the one that crippled Truss. If major changes to the EPL are not proposed and ultimately passed in Parliament, the country’s economic death spiral will likely accelerate. If she does try to scrap the tax, she’s likely to face fierce opposition from the Miliband wing of the Labour Party.

One way or another, Reeves will soon confront a historic fork in the road. Let’s hope she takes it.

“♡ Like” this piece or be forced to attend COP30.

Vibrant comments section today 🤣

It appears we are approaching the finish line in the race between the UK and Germany to self immolate their economies via insanely poor energy policies. for a long time, i thought Germany was in the lead, but apparently, Rachel Reeves has the opportunity to tell Germany, "hold my beer" and put the final nail in the coffin. Given her track record of massive incompetence, i expect she will make the worst choice possible.