On The Ascend

China is winning the chip war because of sanctions, not in spite of them.

“Necessity never made a good bargain.”—Benjamin Franklin

Each day, in the heart of double-decker-sized machines, acts indistinguishable from magic are performed. Powerful lasers fire thousands of pulses per second at microscopic droplets of ultra-pure tin, generating a steady plasma that emits extreme ultraviolet (EUV) light with a wavelength of just 13.5 nanometers (nm). That light is collected by an array of cutting-edge mirrors—each crafted with unprecedented precision, material science innovation, and engineering complexity—and redirected to etch features smaller than 10 nm onto thinly sliced wafers of the world’s highest-quality polysilicon.

Advanced EUV lithography machines sit at the technological frontier of what is arguably the most important industry in the global economy: the manufacture of high-performance semiconductor chips used in demanding computing applications. While predecessor deep ultraviolet (DUV) machines remain the global workhorses for producing chips found in cars, appliances, and various industrial devices, EUV machines are essential to artificial intelligence (AI) technology. Today, the Dutch company ASML holds a monopoly on EUV machine production and sports a market cap exceeding $270 billion as a result.

Given the military implications of AI’s potential, the US has pursued an aggressive strategy of preemptively sanctioning Chinese technology firms—measures designed to prevent any company wishing to operate within the US dollar-based financial system from aiding China’s AI development. For years, ASML has been prohibited from selling EUV and even certain advanced DUV machines to China, while leading US-based chip designer Nvidia has been instructed not to sell its most powerful products there.

The common perception is that these sanctions have largely succeeded in stalling China’s progress and keeping it years behind the best of the West. In earlier posts, we warned that such an advantage would prove fleeting and predicted that China would not only catch up to but ultimately surpass the West.

News broke last week that should call into question the entire sanctions strategy:

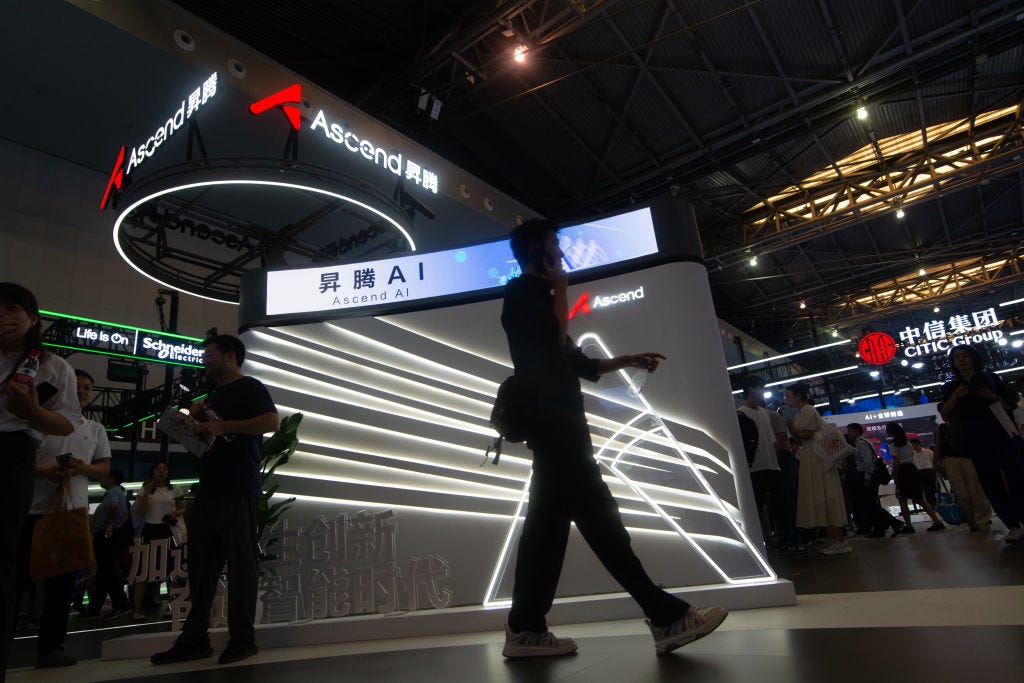

“Huawei Technologies, China's tech titan, is making waves with its latest AI chip, the Ascend 910D, set to rival Nvidia's industry-leading H100 processor. Announced on 27 April 2025, this move marks a bold step in China's quest to break free from U.S. tech dominance, especially as Washington tightens export controls on advanced chips…

Meanwhile, the 910C, already in early shipments, is slated for mass production next month, filling the void left by Nvidia's restricted H20 chip, which now requires an export licence. Huawei claims the 910D could surpass the H100's performance, a feat that would disrupt Nvidia's 80% grip on the global AI chip market, according to The Wall Street Journal.”

From the outset of the war in Ukraine, we argued that sanctions against Russian energy would backfire. More than three years later, Russia weathered the sanctions storm, emerging stronger than it had been before—a result sharply at odds with the narrative still being peddled by Western legacy media. Semiconductors are not energy commodities, of course, but attempting to corral their development through sanctions against China was destined for a similar fate.

Today, we sharpen that view into a broader thesis with serious repercussions for Western foreign policy and the future of the US dollar itself: Sanctions against powerful countries are always a losing tactic, weakening the West and strengthening its geopolitical adversaries at every turn. Further escalations likewise follow suit. Let’s look at recent developments in the semiconductor race to explain why.