On Your Mark

“Time wounds all deals, sometimes even fatally.” – Stephen A. Schwarzman

For enterprising retail investors, the prospect of owning and leasing real estate – finding a nice property, borrowing some money from a bank to achieve some leverage, having tenants effectively build equity for you – can be an alluring way to compound wealth. As with all investments, there are downsides! Renters can be hard to find, and when you do find them sometimes they skip rent, damage the property, or ignore eviction notices. Property values can go down, interest rates can increase, and getting equity out of such investments can be challenging, especially on short notice.

Real estate investment trusts (REITs) are meant to circumvent some of these downsides while still offering investors exposure to the sector. First encoded into US law in 1961, REITs allow limited partners (LPs) the chance to own a slice of a diversified set of properties in a tax-advantaged way without all the headaches of moonlighting as a landlord. Those headaches are instead felt by the general partners (GPs) who run the trust and are responsible for sourcing deals, performing due diligence, arranging financing, finding tenants, collecting rent, and so on. REITs can be privately held or publicly traded on the stock market.

Although popular, REITs are not without their own set of risks. In privately held REITs, LPs must often agree to lock up their capital for an extended period, leaving them at the mercy of how well GPs perform their duties. In publicly traded REITs, investors enjoy the prospect of daily liquidity, but trusts can trade at wide deviations from their underlying net asset value (NAV). In both instances, REIT investors are still exposed to general market, interest rate, and leverage risks. As with all investment decisions, identifying and quantifying risks – and whether you are being properly compensated for taking them – is the essence of the exercise.

Six years ago, the alternative investment management giant Blackstone launched a private REIT directed at retail investors that addressed some of the challenges associated with traditional products. Critically, when the Blackstone Real Estate Income Trust (BREIT) was pitched to prospective investors and their registered investment advisors (RIAs), Blackstone emphasized that shares in the trust would be redeemable on a monthly basis, thereby solving the problem of extended lockup periods and thus expanding the base of potential investors considerably. With a minimum investment of only $2,500, and “suitability standards” dropped to those whose net worth exceeded $250,000 (or just $70,000 for those who could prove an annual income of $70,000 or higher), BREIT offered institutional-quality money management to everyday investors. It became a smashing success for the firm. By late 2022, the mammoth trust grew to approximately $70 billion in assets and counted more than 200,000 investors in its capital table.

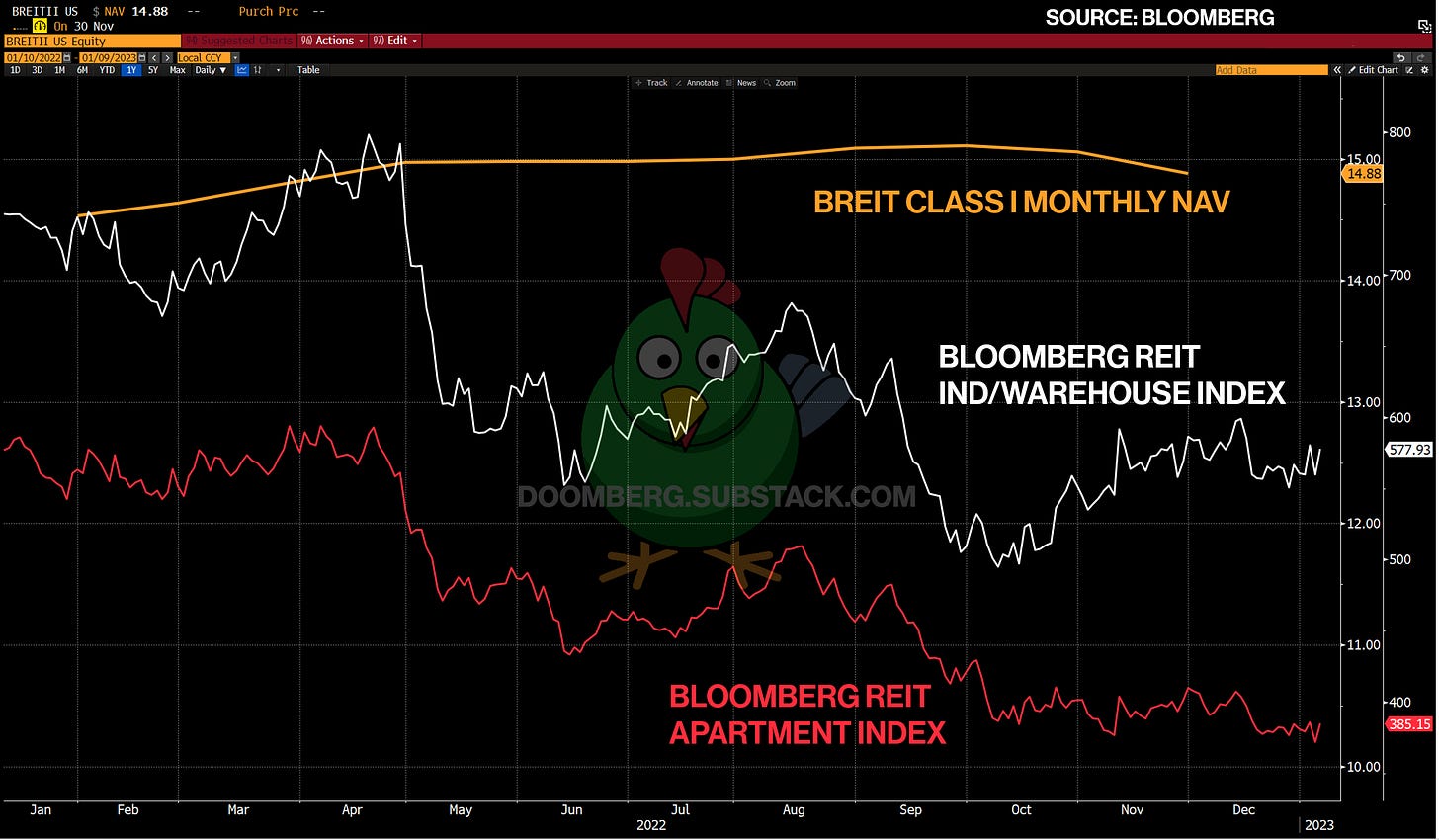

With the Federal Reserve raising interest rates at a rapid pace, and demand for most forms of real estate waning, REITs suffered a historic rout in 2022, with many down more than 20% on the year. Despite these macroeconomic and sector-specific headwinds, Blackstone’s BREIT reportedly bucked this trend, delivering an 8.4% return year-to-date through November, according to the company’s latest update.

One would be forgiven for assuming this stellar outperformance would bring in even more investor funds, but instead, the opposite has occurred. In early December, Blackstone stunned the market by announcing it was gating investor redemptions (emphasis added throughout):

“Blackstone’s big retail real estate fund could see heavy redemptions at its 5% quarterly limit through the third quarter of 2023, according to a note Thursday from Credit Suisse analyst Bill Katz—the lone bear on Blackstone among roughly 20 Wall Street analysts covering it.

Blackstone Real Estate Income Trust—a real estate investment trust (REIT) with a net asset value of $69 billion—said last week it was putting up redemption limits after withdrawal requests exceeded its 5% quarterly limit in the current quarter. The news has depressed shares of Blackstone (Ticker: BX) because the firm’s retail business has been a prime source of the company’s growth.”

Why might investors be scrambling to exit a product that has performed so well and is backed by one of the bluest of the blue-chip names on Wall Street? Will recent moves made by the company shore up investor confidence enough to abate the crisis? Let’s dig in.