Shooting Oil in a Barrel

“War is a contagion, whether it be declared or undeclared.” – Franklin D. Roosevelt

On July 26, 1941, President Franklin Delano Roosevelt (FDR) seized all Japanese assets in the US and imposed a strict oil embargo on the country. Britain and the Dutch East Indies – the colonial predecessor to modern-day Indonesia and a major oil supplier to Japan – quickly followed suit. Virtually overnight, Japan lost three quarters of its trade and nearly 90% of its oil imports. Faced with limited domestic oil inventory, minimal capacity for production, and few options beyond a humiliating surrender of their geopolitical aims to a hostile foreign power, Japan made the fateful decision to go to war with the US. The attack on Pearl Harbor a little more than four months later was driven by Japan’s ultimate need to occupy, defend, and exploit the energy bounty of the Dutch East Indies, which they proceeded to do a month after severely weakening the US forces in the Pacific.

If energy is life, then the lack of energy is death. When one stares death in the face, to fight – however remote the odds of victory might be – is the only rational option. The actions of Japan make sense in that context. As brilliantly explained in Daniel Yergin’s iconic book The Prize: The Epic Quest for Oil, Money & Power, modern history is best viewed through the lens of energy: the pursuit of that which is not had, and the use of that which is. Bombs are nothing more than carriers of extreme amounts of potential energy and unleashing that energy in targeted areas has the effect of creating devastating disorder in those environments. Wars are ultimately decided by which side can harvest and deliver more destructive energy to the other, explaining Churchill’s obsession with the Middle East and Hitler’s decision to prioritize Germany’s drive on The Caucasus prior to toppling Moscow – a choice that likely cost him the war.

The US was an energy superpower during World War II and as its soil was unlikely to become a direct battlefield, whether and how the US might participate would prove decisive. The existing combatants expended significant resources attempting to influence this all-important outcome. In his excellent but brutally critical book The New Dealers' War: FDR and the War Within World War II, decorated historian Thomas Fleming lays bare just how desperate FDR was to provoke Japan into war. Most disturbingly, the book documents how the British and, to a greater extent, Stalin’s Russia infiltrated and corrupted much of the geopolitical policy-making bureaucracy of the US, thereby tilting the scales in their favor.

The US is still the largest producer of oil and gas in the world, making its energy policy – and the desire of foreign powers to influence it – no less important than it was then. Longtime readers of Doomberg will know we have been critical of America’s energy strategy and have spilled much ink describing the predictable consequences of its obvious blunders. By closing existing nuclear power plants, opposing the development of reliable fossil fuels at virtually every opportunity, attacking existing energy infrastructure choke points, and constraining capital for future development, the behavior seems virtually indistinguishable from what we would be doing if an adversarial foreign power were in charge of our affairs.

Consider the big news from last week. On Thursday, a lone federal judge appointed by former President Obama revoked entire swaths of recently auctioned oil and gas leases in the Gulf of Mexico. Here is the New York Times reporting on the decision (emphasis added throughout this piece):

“A federal judge on Thursday canceled oil and gas leases of more than 80 million acres in the Gulf of Mexico, ruling that the Biden administration did not sufficiently take climate change into account when it auctioned the leases late last year.

The decision by the United States District Court for the District of Columbia is a major victory for environmental groups that criticized the Biden administration for holding the sale after promising to move the country away from fossil fuels. It had been the largest lease sale in United States history.

Now the Interior Department must conduct a new environmental analysis that accounts for the greenhouse gas emissions that would result from the eventual development and production of the leases. After that, the agency will have to decide whether it will hold a new auction.”

The environmental group behind the push to obstruct the oil and gas industry – and the first one quoted in the full New York Times article – is an outfit called Earthjustice, which describes itself as the premier nonprofit public interest environmental law organization. They boast of deploying 170 lawyers against “630+ active legal proceedings.” Here is their homepage, where they unironically declare what is actually being delivered to Mother Earth….legal fees:

A perusal of their main policy page titled “Power Everything With 100% Clean Energy” reveals zero mentions of the word “nuclear,” and using this keyword to search their website uncovers a string of mostly negative commentary on the topic, confirming our suspicion that members of Earthjustice are either anti-human, deniers of physics, or both. Of course, armed with unlimited financing and the confidence of a noble cause, one should expect the organization to be quite content to busy themselves in the Byzantine US court system rather than consult the physics primer.

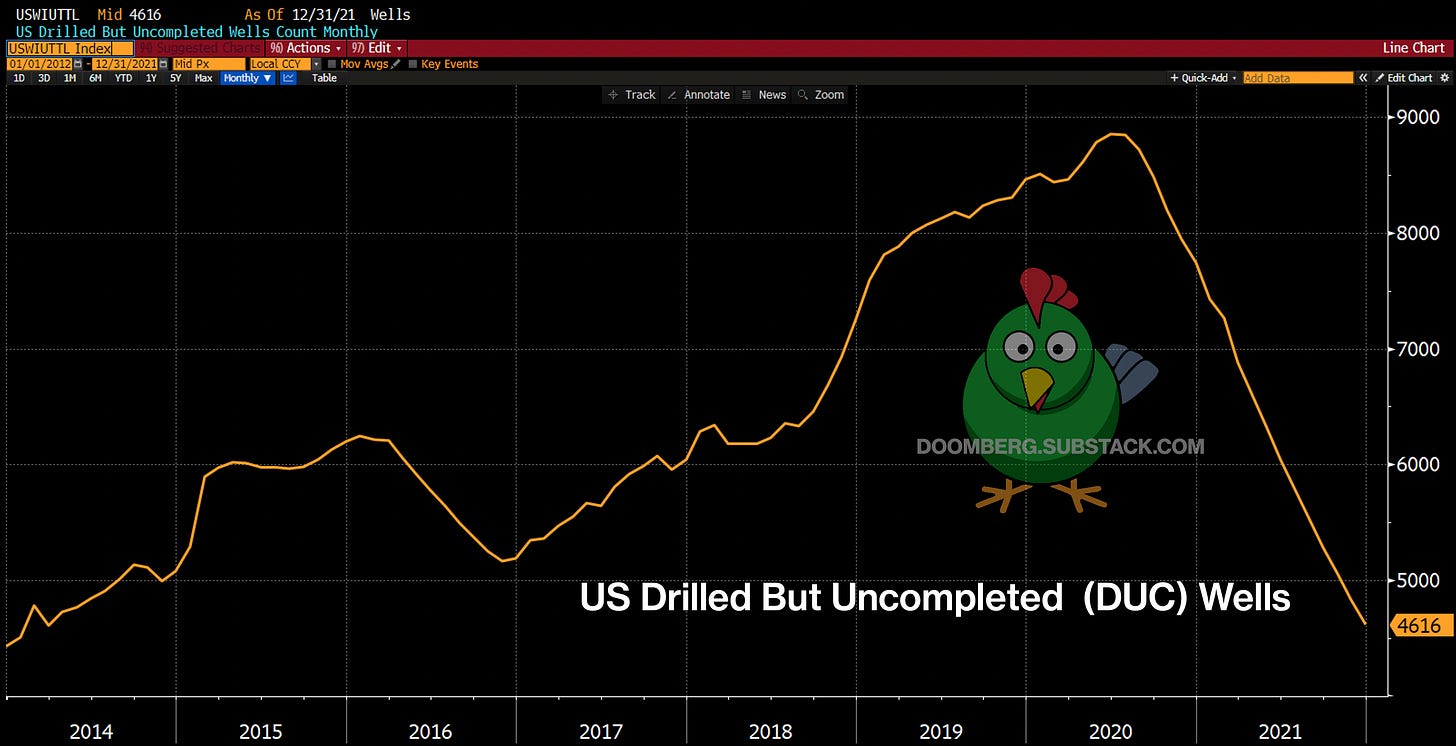

How close are we to the edge of the energy abyss? For clues, we turn to the latest data from the oil patch, where evidence builds that US producers are draining their working capital of drilled but uncompleted wells (DUCs) at a furious pace. The December reading of 4,616 is the lowest since early 2014 and represents a precipitous decline of 48% from the pre-Covid highs.

As pointed out by our friends at Bison Interests in their monthly newsletter (mandatory reading for those interested in the oil and gas sector), even this number likely understates the situation:

“US oil production may grow less than expected as the industry depletes its inventory buffer and loses flexibility to increase production to response to rising demand. This simple shift from drilling to completion is obviously unsustainable, and absent a material change, may result in disappointing production and higher prices.

Compounding problems for producers, DUC inventory shortages may actually be worse than reported. Historically, 95% of wells drilled have been completed within 2 years; DUCs older than 2 years are considered “dead” and the probability they are completed falls drastically. The inventory of live DUCs likely to be completed is likely overreported, as most conventional sources fail to make this important distinction.”

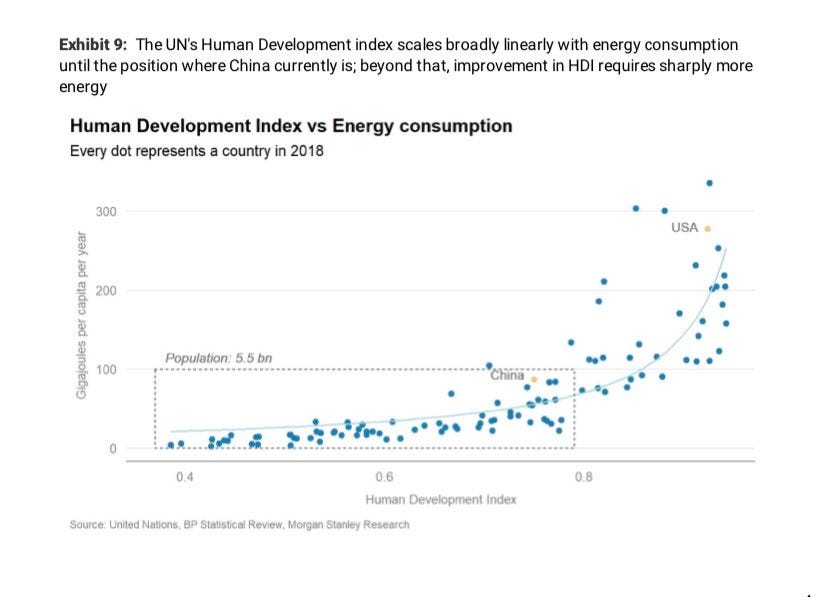

With demand for oil and gas already surpassing pre-Covid levels and set to rip higher once the global economy fully reopens, the stage is set for an epic blowoff top in energy prices. The gap between suppressed supply and unquenchable demand could stretch to unthinkable levels, just as a sizable wedge of the world’s population sits on the cusp of a well-known and substantial step-up in demand. To illustrate this concept, first brought to our attention by the team at Goehring & Rozencwajg, shown below is a chart originally published by Morgan Stanley. It is a powerful visualization of demand for energy on a per capita basis which soars once a certain standard of living is achieved. Represented here as the Human Development Index, a composite index of life expectancy, education, and per capita income, it is used by the United Nations to rank countries into tiers of human development. As notated on the chart, nearly 5.5 billion people reside below the take-off point, and their expectations won’t be easily constrained.

We close with a few words of caution for those investors looking to profit from the forces converging to drive energy prices higher: time your trades carefully. While we never give investment advice here at Doomberg, history teaches that the tighter the elastic band of high energy prices is stretched, the more violent the snap back to reality as the economy simply can’t grow under conditions of extreme energy shocks. As evidence, we present a somewhat provocative chart we published on Twitter earlier this month which depicts how the Nasdaq performed before and immediately after the price of oil pierced new all-time highs just prior to the global financial crisis.

As the old saying goes, correlation is not causation but it sure is a hint.

If you enjoyed this piece, please do us the HUGE favor of simply clicking the LIKE button!

Excellent follow up to your previous articles on energy. I was already aware of the WW11 issues including FDRs "secret" battle to get the US into the war after 1940, and also of the intense lobbying that was going on by the UK and others to get the US involved. However your point about energy being the effective life blood of the industrial world is worth repeating endlessly. It will be impossible to switch from hydrocarbon fuels in anything like the ridiculous timeline proposed by the COP forums and the Build Back Better propaganda being driven by the WEF under Klaus Schwab and his acolytes (including Draghi, Lagarde, Ardern, Trudeau, Von der Layen and others).

What is absolutely going to happen is that oil is going to hit a new record high price and sooner than many can possibly believe. In just 18 months between Jan 2007 and June 2008 oil went from $60 to $140 / bbl. The inflation adjusted price of that $140 today is just shy of $180 /bbl. I spent 42 years in the upstream oil and gas business in engineering and operations management roles and can promise everyone that an oil spike is coming, largely driven by both activist and political actions. It may be that these forces believe a very high oil price will help push the Western public fully into the arms of those demanding a green energy switch sooner rather than later (accompanied by carbon taxes, green bonds and other government revenue approaches design to replace the Sovereign Bonds they can no longer easily sell). I believe that the resulting chaos will do the exact opposite and worse...... the horribly indebted Western nations will finally dissolve into financial and political chaos. Oil will be the catalyst.

I subscribe to Goehring and Rozencwajg's writings and strongly recommend them to anyone who needs to understand the natural resource tsunamis all around us. ESPECIALLY their debunking of green energy efficiency, cost and CO2 reduction propaganda. Finally, please note I am not anti green energy, nor a climate change denier, but the direction we are currently heading in will bring disaster way-long before rising sea levels harm us. Perhaps that is what some want.....

"The US’s behavior towards energy seems virtually indistinguishable from what we would be doing if an adversarial foreign power was overseeing our affairs."

Much like Nobel Prize winning Physicist Glenn T. Seaborg's comment about the American Educational System.

Make no mistake. Our democracy IS being threatened. And the side that is actively working to destroy it is the "American" left. They are no longer our countrymen. With luck they will be booted out of office come November.

However ... the voters continuing to elect destructive leftists in 3rd-world s41th0les like Portland lead me to think many of my 'fellow Americans' WANT the country to fall apart.

Sad.