“Popular culture bombards us with examples of animals being humanized for all sorts of purposes, ranging from education to entertainment to satire to propaganda. Walt Disney, for example, made us forget that Mickey is a mouse, and Donald a duck. George Orwell laid a cover of human societal ills over a population of livestock.” – Frans de Waal

…and here Doomberg, a chicken.

I woke up this morning as I always do: I poured myself a cup of coffee and perused my favorite periodicals in search of things that scare me. As I’m sure you’ll know by now, the big news of the day is the red hot, fresh-off-the-presses CPI print. Concurrently, you likely can’t help but notice being bombarded with propaganda centered on one word – transitory.

I fired up my Google machine and typed “transitory.” Before I could even press enter, a fantastically simple preliminary answer was suggested. I captured a screenshot:

Not permanent. It’s so perfect. Literally true and meaningless at the same time. No wonder our financial overlords have settled on that word. Of course, nothing is permanent – everything has an end. Thermodynamics makes it so. Even bouts of hyperinflation eventually subside, perhaps to be repeated again if the proper lessons are not learned. That something will eventually end says nothing about the incredible pain and suffering that can happen between now and the endpoint, but I suppose it’s best to make people focus on the rebirth while ignoring the inconvenient death in between. Hope appears to be our strategy.

I sauntered over to my Bloomberg terminal and spent the morning doing what I love to do – making charts to visualize interesting data. Let’s have a look...

First up, 30 years of CPI data. This morning’s print is the second hottest on the chart, bested only by the heights reached during the last global financial crisis.

Next is Core CPI over the same time period. Core CPI strips out energy and food from the CPI data (who needs those things anyway?), which tends to dampen volatility. By that measure, the last time inflation was this hot, Ross Perot was on a presidential debate stage complaining about unsustainable fiscal budget deficits (how quaint, may he rest in peace).

The biggest driver of the increase in CPI data is used car prices. Our friends at Manheim put together this lovely index, which I’ve used in previous Doomberg pieces. Inspection of the latest data indicates things are still going vertical. As the proud owner of a new pickup truck (more on that another time), I can assure you I was thrilled to source the model I wanted and happy to effectively pay full price. The dealer seemed pleasantly surprised at my willingness to do so. You know it is a good deal when both sides feel like they ripped off the other.

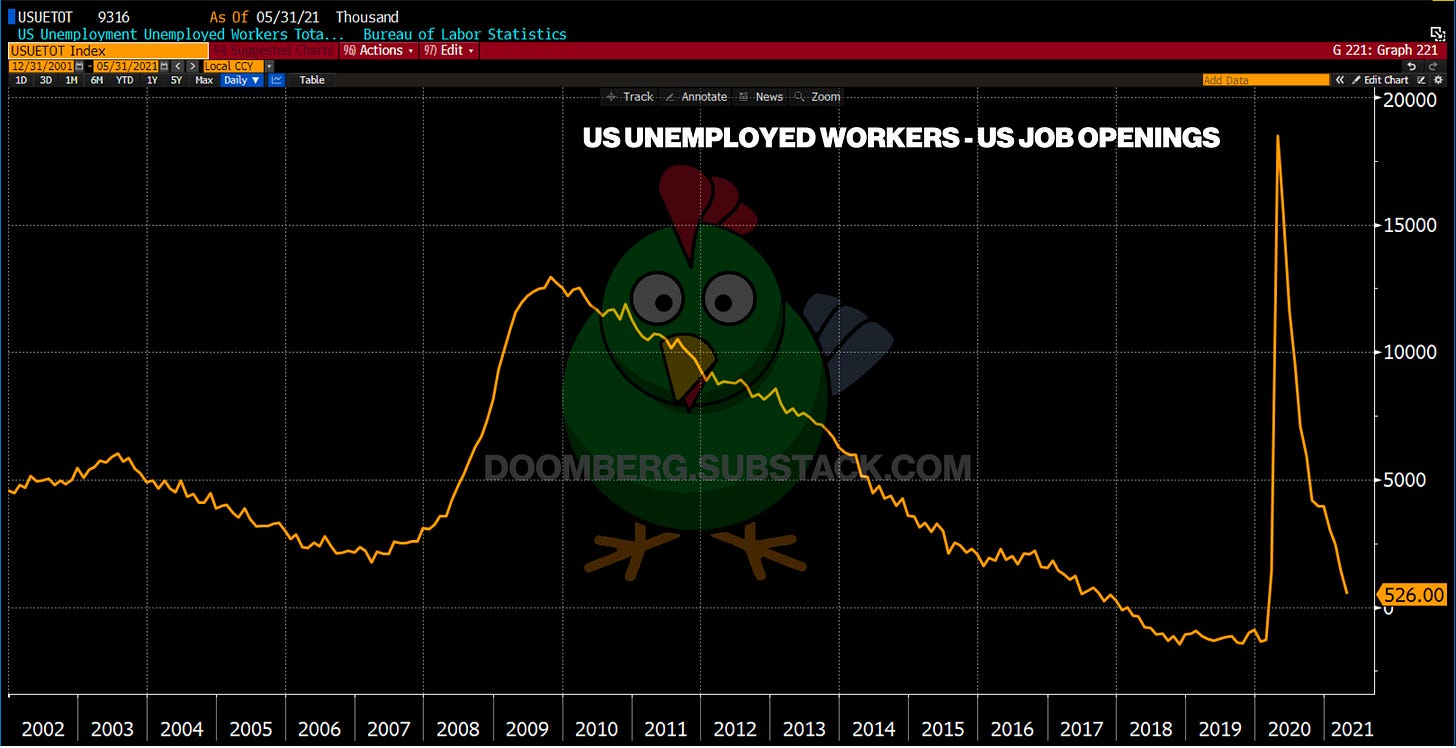

Central banks around the world seem focused on wage inflation, and have proclaimed they won’t be too concerned about inflation until we see a measurable uptick in labor’s share of the economy. Judging by the number of unfilled jobs in the US, we seem to be on the brink of a labor shortage.

The flip side of job openings is people currently unemployed but actively looking. That number is falling precipitously as the economy reopens, and will soon reach levels last observed prior to the pandemic.

My personal favorite measure of full employment can be found by subtracting the two. I predict when the May open jobs number is released, the delta will turn negative once again, putting further pressure on wages.

I could go on. Other charts that look interesting include monthly US Federal budget deficits, the size of the Fed’s balance sheet, expansion of the money supply, and the chart of the US dollar against a basket of currencies. They all seem oriented firmly in the “inflation must be here” camp.

Except one.

Yields.

Well, maybe two. Yields and breakevens. Both are yawning as though inflation is, in fact, transitory. Nothing to see here. The 10-year breakeven chart (which is simply the difference in interest rates for TIPS versus the standard Treasury note) is pricing in an average inflation expectation of 2.35% over the next 10 years, down from yesterday’s close.

If I knew how to trade breakevens, I’d be betting on a much higher number pretty soon. Having said that, it’s a good thing I don’t know, because I’m sure it would cost me a lot of money. As my friend Pony Sneer says:

“Read the chicken. Enjoy the chicken. But don’t trade the chicken. Fade it.”

If you enjoy Doomberg, sign up yourself and share a link with your most paranoid friend!

Pony Sneer equals Tony Greer…yes? 🤗

Are we supposed to believe that somebody out there wants to buy the 10Y, or these "TIPS"... With their own hard-earned money? No, only people with free unlimited printed money would buy those things.

This scheme will work until one day, a big crisis will cause all of it to stop working all at once and they won't be able to open the markets.