What Does Price Mean When There’s No Supply?

“The greater the penalties laid on sellers in the black market, the higher the black market price.” – Kenneth Boulding

I had a chance encounter with a crypto bro a few weeks ago. He was pitching his new whiz bang social media app and I just happened to be in the small audience. Well, he wasn’t formally pitching. In the venture capital world, every deal is oversubscribed except for the ones that are undersubscribed, and so he was giving a sneak peek at his next hot startup and pretending like he wasn’t in the market for money – the barrage of name-dropping and buzzwords that followed notwithstanding.

This kid was a caricature. Mid-20s, totally underdressed, a couple million followers on Instagram, and fresh off his first decently successful exit. The only recognizable bridge to the people he was pitching was the Rolex watch he had on his wrist, easy to notice because he was wearing a T-shirt. A two-tone Datejust with a smooth bezel? Rookie move, I thought to myself.

He was utterly and sweetly sincere. A crypto bro from the early days of bitcoin, he swiped open his phone at the break to eagerly show me his portfolio and proudly proclaim that he was long and strong, with 95% of his newfound financial net worth invested in various coins and non-fungible tokens (NFTs). I asked him if he was worried about a crash and he confidently asserted crypto is the future of money and could never go down for very long. Naturally, his new app had ample tie-ins to crypto, distributed finance (DeFi), and NFTs. When I asked him if he was worried about know your customer and anti-money laundering regulations (KYC/AML), difficulty getting banking, and so on, he brushed concern aside, citing how careful he was about such things.

I won’t tell you where he claimed to be banking, or why he thought banking there somehow indemnified him from what I suspect will be an imminent crackdown on the sector, but let’s just say his answer took him off my board of investable people, despite how much I liked him and admired his energy. Ironically, odds are pretty good he’ll eventually (temporarily?) become a billionaire, just not in a way that I can participate.

I couldn’t get that meeting out of my head, but not for the reasons you might suspect. I couldn’t stop thinking about that Rolex! Everybody knows that if you are going to buy a Datejust, you buy one with a fluted bezel. Were market trends shifting? Did his purchase represent a generational change in taste that I needed to understand?

And then it hit me.

He bought that watch because he walked into an authorized Rolex dealer – thinking he “needed” a Rolex for his various pitch meetings – and that’s all they had on offer. He simply bought what they had left in stock, which wasn’t much.

In many ways, what has transpired in the market for fine watches in the past few years is a striking example of how supply shortages and price controls – artificial or otherwise – lead to the development of black markets, the circumvention of established rules of order, and the corruption of key players in the supply chain. I’ve been meaning to write about this fascinating Rolex situation for a while, and my chance encounter with the crypto bro reignited my motivation to do so.

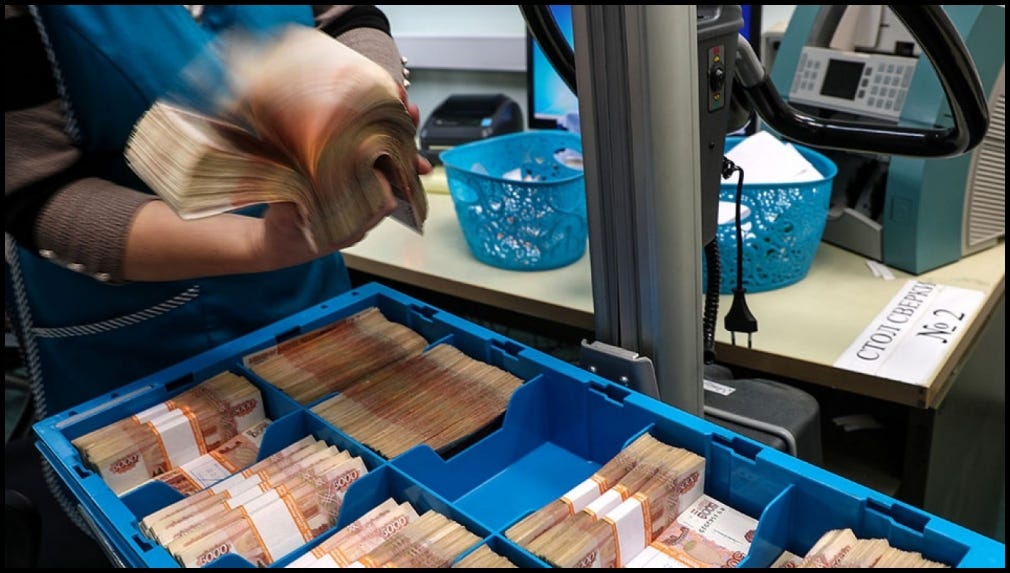

When one thinks of black markets, the image that usually comes to mind involves failed states, hyperinflationary environments, and dangerous back alleys. Sure, the government might tell you a loaf of bread costs 10 units of local currency, but bread isn’t trading hands anywhere near that price for most buyers. Instead, a few corrupt intermediaries get to buy at the official price and then flip it to hungry people at street level for a handsome profit.

In the early stages of full-blown hyperinflations, it’s usually the most life-critical or popular goods that get hit first. Eventually, inflationary pressures inhibit production of all manner of goods, corruptible intermediaries mimic the self-enrichment schemes of the bread barons, and citizens begin to lose faith in the currency itself.

I’m the first to admit that it is silly to compare Rolex watches to bread. But in a bizarre way, the exact phenomena described above is playing out in plain sight, except in this story Rolex is the government, authorized Rolex dealers and shady resellers are the corruptible intermediaries, a popular watch trading app is the dangerous back alley, and the desperate buyers aren’t physiologically hungry – they are simply seeking monetary calories they can store for future consumption.

Rolex is an iconic brand, one that is synonymous with achievement, luxury, and yes, a fair bit of snobbery. It also has a strong cult following that has allowed the brand to thrive despite an onslaught of technical innovation in timekeeping – everybody owns a phone that can accurately track the time of day down to the microsecond. While Rolex watches keep great time, timekeeping is no longer their primary purpose. People love them for their beauty, their status, and their strong track record as a hedge against inflation. Unlike most other brands, Rolex cares deeply about the resale value of its watches and has a long tradition of carefully managing new supply to protect historical buyers. In recent years, their value as an inflation hedge has made them especially interesting, both as a personal investment and as a data point worth watching for trends in consumer psychology.

Recently, the price of Rolex watches has gone hyperinflationary. For reasons nobody fully understands, supply has dried up. Visit any authorized dealer today and you will find almost nothing to buy. The display cases are literally empty. There are a few undesirable models sitting around – smooth bezel Datejusts and the like – but you aren’t finding any watch that one would have considered even the least bit desirable just two or three years ago.

Getting a Rolex authorized dealer in your mall is considered a coup. As a jewelry store owner, it can make your franchise incredibly valuable. Getting approval is difficult and so is keeping it. By policy, Rolex sets the official price of every watch. Authorized dealers are forbidden from selling at a price that deviates from the catalogue, up or down. There’s no haggling with a Rolex dealer. Critically, no retail customer can call Rolex directly to order a watch – they can only be bought new at a dealer.

The shortages began with the most popular models and with new releases. At first, dealers selected which of their favored customers would be “allowed” to purchase the hot new models at the official Rolex price. Naturally, these newly purchased watches began appearing on watch resale sites at measurably higher prices, often described as “new/unworn,” listed by individuals staring a great “flip” in the (watch)face. Eventually, the preponderance of listings were by jewelry stores that weren’t authorized Rolex dealers, and the shortage spread to virtually all models.

When COVID-19 hit, Rolex production was impacted, triggering the next wave of panic buying and shortages. Collectors began hoarding whatever new watches were available and prices for used and vintage models also went through the roof.

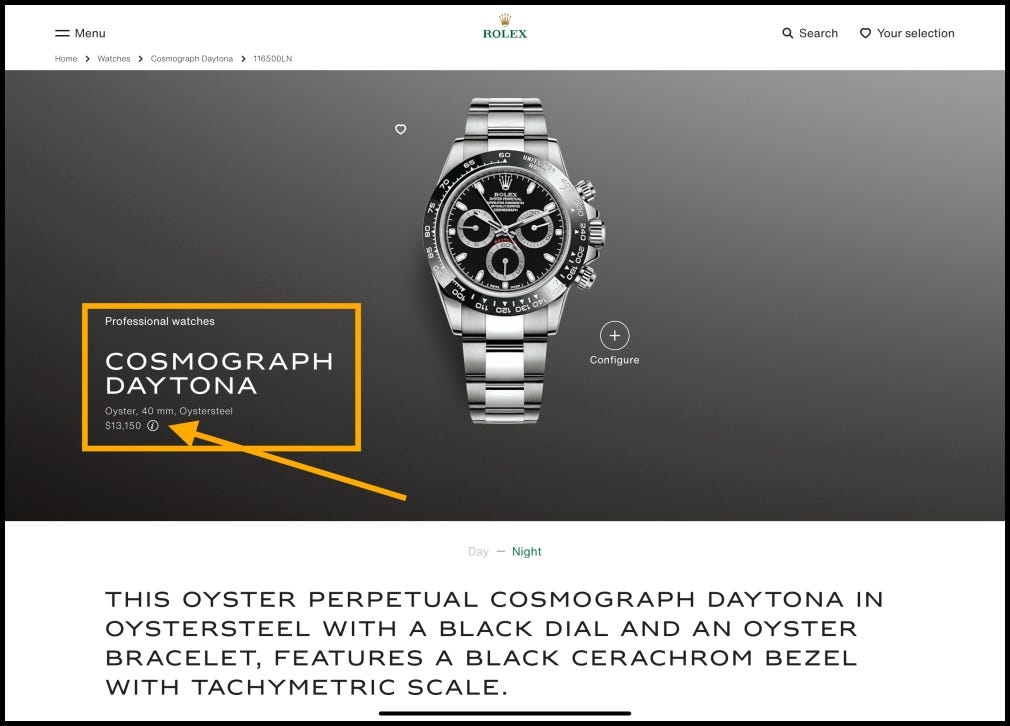

To illustrate, if you bring up the official Rolex website today, you will find the list price of a Daytona is $13,150. That’s a lot of money for a watch, no doubt, but it is also a totally irrelevant price, no different than the proverbial loaf of bread.

To discover the true price of a new Daytona, head over to Chrono24 – the most popular online watch market – and search “116500LN.” You’ll find more than 100 models to choose from, most of which are “new/unworn” and offered directly by jewelry stores. The price ranges from $32,500-$40,000, or roughly three times the official Rolex list price.

How did all of these new watches end up in the hands of non-authorized jewelry stores? Authorized dealers are forbidden from selling units at any price other than $13,150. Are they just handing out spectacular deals to their competition for nothing in return? Of course not. Either directly or indirectly, deals are being cut, money is changing hands, and watches are flowing from Rolex through authorized dealers and onto Chrono24 before any retail buyers can even see them.

It is almost farcical to walk into an authorized Rolex dealer today. The juxtaposition of gorgeous branding and store design with empty display cases and bored salespeople is the perfect metaphor for our time. This is a façade of commerce, and it is hard to see how it reverses.

The psychological factors that drive economic forces are universal. Inevitably, there is a true price for everything – be it bread, watches, or yes, even interest rates. Attempts to control or distort those prices must eventually backfire, moving commerce below ground. As we learn of more shortages on the horizon resulting from knock-on effects of knock-on effects, I expect we’ll see a big yawning jaw of list price vs. true price on all manner of goods. There is no other way. Like Rolex, we may discover that this time is no different.

If you enjoy Doomberg, subscribe and share a link with your most paranoid friend!

I was reading the article and waiting for the moment when it would say "I'm joking, this really is about Xbox and Playstation consoles and GPUs"

Thanks, what a great article. As we're all experiencing, this phenomenon is occurring in all aspects of the economy. Examples include farm chemicals (Roundup $9/gal last year, now $60/gal), fertilizer (double), firearms, food, steel, vehicles, anything that has real material value. Your example, using the dealer network 'list' for pricing is an excellent one. Many dealers have this very rare pricing power where they can proudly or secretly get more than list price for their products...

One item that isn't experiencing this are the precious metals. I've always heard they do best in deflationary environments and so that seems to be true. Thanks again.