Dead of Winter

Is another European energy crisis in the offing?

“Anyone who has ever struggled with poverty knows how extremely expensive it is to be poor.” – James Baldwin

Depending on whose propaganda you believe, Russian special forces either recently executed one of the most audacious and successful military operations in modern history or recklessly sacrificed elite soldiers in a failed publicity stunt.

According to the Russian account, as many as 800 warriors crawled 15 kilometers through the Sudzha natural gas pipeline and waited there upwards of four days before emerging behind enemy lines, sowing chaos among the Ukrainians and collapsing several strongholds. The Ukrainian side recounts the event quite differently, claiming that nearly all the Russian troops were killed in action and posting videos in support.

As civilians based in the US, we can’t possibly know what happened, but energy infrastructure wantonly attacked (again) and used as cover for direct assault are troublesome developments. This most recent offensive marks a dangerous escalation—one certain to further strain the already fragile energy relationship between Russia and Europe. Julian Röpcke, a senior editor at the widely read German newspaper Bild, went so far as to post on social media that all Russian pipelines connected to Europe should be blown up to prevent subversive use. (He has since softened that comment in a follow-up post.)

Such loose talk is not without consequences, of course, and it comes at a particularly inopportune time for Europe. After a somewhat colder-than-average winter and the cessation of gas flows through the very Sudzha pipeline that Russian special forces just snaked through for their surprise assault, European natural gas storage levels are at dangerously low levels for this time of year:

The last energy crisis began many months before Russia’s military crossed into Ukraine. Europe’s vulnerability—driven by a foolish decision to forgo topping off its reserves in the summer of 2021—almost certainly convinced Russian President Vladimir Putin that he held sufficient leverage to risk war in early 2022. Three years later, with the conflict seemingly entering its final stages, surely the continent isn’t repeating the mistakes of the recent past? Perhaps it is:

“As the first proper winter in Europe in three years is drawing to an end, the continent faces a race against time—and prices—to restock with natural gas for next winter…

Europe could need as many as 250 additional [liquefied natural gas] LNG cargoes to arrive in the summer to refill its inventories back up to 90% by November 1, as the current EU regulation stipulates, per Reuters calculations reported by columnist Ron Bousso… The LNG market appears to be tightening, with supply not rising fast enough in early 2025 to meet demand.”

The world is a different place now, and the scars of the last crisis have driven massive investments aimed at improving global energy supply resilience. Will they be enough to help Europe avoid another emergency? What milestones should investors watch for as early warning indicators? Let’s head to Brussels for a balanced assessment of the situation.

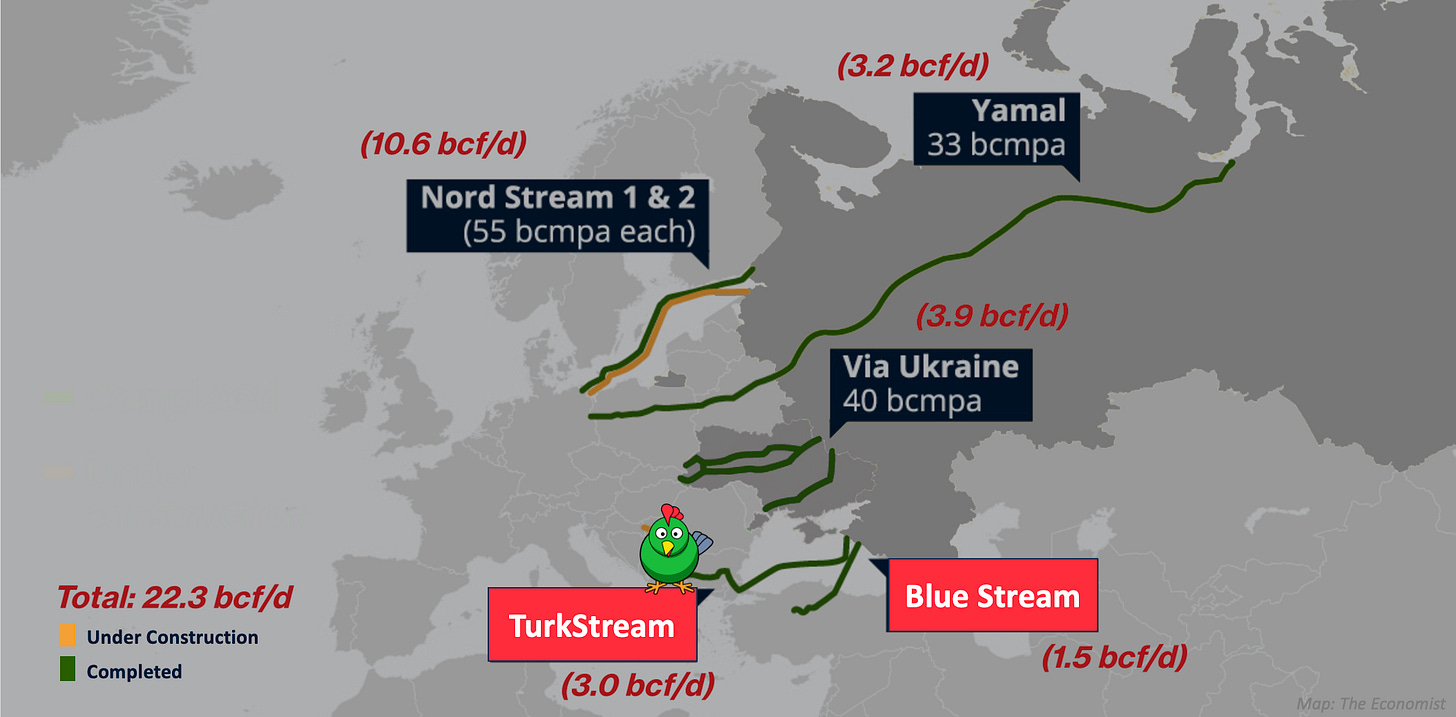

Europe’s vulnerability is now measurably higher compared to three years ago. Russian natural gas no longer flows through the Nord Stream and Yamal pipelines, nor various connections through Ukraine, eliminating access to a total capacity of 18 billion cubic feet per day (bcf/d). Only the two pipelines entering Turkey via the Black Sea—TurkStream and Blue Stream—are still pumping gas. The balance of European demand will need to be met by expensive LNG imports, primarily from the US and Qatar.

Unfortunately for Europe, the LNG market has been facing challenges just as the continent appears poised to rely on it more than ever. In its widely read annual status report on the market, Shell chronicled the struggle:

“Several LNG projects have seen delays over the past two years due to geopolitical tensions, regulatory hurdles, labour shortages and supply chain bottlenecks, delaying the availability of around 30 million tons of new LNG supply, the size of India's LNG imports, to 2028.

In 2024, global LNG trading rose by only 2 million tons to 407 million tons due to constraints on development of new supply, marking the smallest annual increase in the past decade, the report said. The report showed that anticipated supply during the period was between 7 million and 20 million tons but it undershot even the lowest end of the forecast range.”

Despite these many delays, some relief is in sight for 2025 with two major LNG expansions activating in the US. Cheniere’s Corpus Christi Stage 3 expansion produced its first cargo in February, adding 1.3 bcf/d of capacity. The first phase of Plaquemines LNG—built by the controversial firm Venture Global and itself a 1.3bcf/d facility—is in the commissioning process, a milestone celebrated last week by Chris Wright, Trump’s new Secretary of Energy. The second phase is expected to come online later this year. Additionally, the long-delayed Canada LNG project should begin exports in the months ahead. The US Energy Information Administration recently covered the activity:

“North America’s liquefied natural gas (LNG) export capacity is on track to more than double between 2024 and 2028, from 11.4 billion cubic feet per day (Bcf/d) in 2023 to 24.4 Bcf/d in 2028, if projects currently under construction begin operations as planned. Between 2024 and 2028, we estimate LNG export capacity will grow by 0.8 Bcf/d in Mexico, 2.5 Bcf/d in Canada, and 9.7 Bcf/d in the United States from a total of 10 new projects that are currently under construction in the three countries.”

Even more supply will reach the markets in 2026 when Qatar’s massive North Field LNG expansion project is slated to come online. That single investment will increase the country’s LNG export capacity by 40%, or more than 4 bcf/d. Qatar plans to add another 4 bcf/d by 2030. If Europe can get through 2025, the odds of a future crisis diminish significantly.

But will they?

The market certainly seems to think so. The forward curve for natural gas at the Dutch TTF hub remains essentially flat at current prices through December before dropping sharply in the years ahead. LNG prices are still three times higher than pipeline natural gas in the US but are down 85% from the intraday highs seen at the peak of the crisis in 2022. The potential for peace in Ukraine and resuming Russian natural gas flows may be influencing prices. We remain skeptical of such an outcome, but if these developments materialize, LNG prices would almost certainly face forceful downward pressure.

It is a similar story for coal, which soared alongside natural gas during the last crisis to previously unthinkable levels. China has been overproducing massive amounts of the fuel, undoubtedly as part of a strategy to insulate itself from Europe’s energy follies. The resulting supply glut recently pushed benchmark Newcastle coal prices near $100 a tonne—levels not seen since mid-2021. Bloomberg covered the trend in late December, before the most recent sharp downturn:

“China’s booming coal production is running well ahead of demand at the onset of winter, leading to swelling inventories and plunging prices that analysts forecast will fall further…

‘An avalanche of inventory is crushing the market,’ Han Lei, an analyst at the China Coal Transportation and Distribution Association, said at a briefing on Wednesday. “Power plants are dumping stockpiles. There’s just too much supply.’”

The one event that could significantly disrupt energy markets and pose a serious challenge to Brussels would be a major terrorist attack on European infrastructure. For example, if either of the large pipelines passing through Turkey were taken offline, prices would likely spike sharply. The loss of a large LNG import terminal, such as those in Spain or France, would also create severe strain. When operating on the edge, even small disturbances can knock the system out of equilibrium.

While Europe is playing an extremely risky game, absent the edge cases, it is likely to muddle through the next year without a full-blown disaster. Consistent with our longstanding approach to energy markets, history has shown it is far more lucrative to fade such emergencies near their peak than to gamble on the timing of their occurrence. Supply shortages are invariably followed by gluts, and should Europe fall substantially behind in its preparations for the upcoming winter, the markets would ultimately work their magic.

“♡ Like” this piece to roll the dice.

And isn't it interesting that apparently the most bellicose of terrorist threats, the Biden administration, may have set off one of those crises by blowing up a portion of the Nord pipeline, leading to energy and economic chaos in Germany....(at least this is who I think caused the mess).

Hopefully saner heads will trade instead of invade and promote expansion of pipelines and trade routes to make everyone warmer and richer at the same time. Europe and the world needs a break from chaos. Hopefully the energy markets can deliver on that while politicians become more interested in their populaces than their own power over them.

Great article.

UK domestic gas production has declined by two-thirds over the last 25 years, while EU volumes are down a whopping 80% (aggravated by the Groningen phase-down). Is there any edge case supply disruption scenario severe enough to jolt the Europeans back to energy security reality? Playing the weather and import casino games year in, year out is an increasingly perilous political path.