“I consider Tesla an ally, as kindred spirits on a mission to reduce the climate impact of the transportation system. But they are doing something that’s much less impactful, not even a fraction of a percent as impactful as what we’re trying to accomplish.” – Pat Brown, CEO of Impossible Foods

Did you know that when you go to the grocery store, your shopping experience is as manipulated as your Google search results? That big box retailers spend billions of dollars tracking your exact movements as you make your way through their stores? What you look at, what path you take through the aisles, and so on? That shelf placement, packaging, and store layout is an incredibly competitive, cut-throat business? That slotting fees are a thing?

The food business is extremely tough. On one end of the value chain, a food company is beholden to wild swings in commodity prices (aka their input costs). One the other end, they have to negotiate price, volume, and product placement with the brutally effective procurement departments of Walmart, Kroger, Albertsons, Whole Foods, and the like. In between, they struggle to eke out a return that exceeds their cost of capital in an asset-heavy industry while competing against other businesses trying to do the same. Competitive moats are hard to come by in the food business, which is why most new entrants fail.

Take Tyson Foods (NYSE: TSN), the world’s second-largest processor and marketer of chicken, beef and pork. With such iconic brands as Jimmy Dean, Ball Park, and Hillshire Farm, Tyson is a formidable competitor with nearly a century’s worth of experience. Perusing their fundamentals (i.e., The Stupid Way™ of analyzing companies), we find annual revenue of about $43 billion, EBITDA profit margins of 10%, net income margins of 5%, and a decent balance sheet. They invest $300 million per year in capital to keep their various food factories humming. The enterprise value (EV) of Tyson – the market value of their stock plus net debt – sits at just under $36 billion, or roughly 0.8 times annual revenue.

Kellogg (NYSE: K), one of the most iconic food brands in the world, does $14 billion a year in revenue and is about twice as profitable as Tyson. They trade at an EV/revenue ratio of just over 2.1. Hormel Foods (NYSE: HRL) does $10 billion a year in revenue and has a stellar balance sheet. It trades at an EV/revenue ratio of about 2.5. There are many others. All these companies have deep brand value, throw off okay cash, grow mostly with GDP, and are generally well run. The financial markets value these enterprises at modest 1-3 times their annual revenue.

Which brings us to our first Super Stonk profile: Beyond Meat (NASDAQ: BYND).

Beyond Meat is a story stonk and the story goes like this: climate change is the single largest crisis facing humanity today and companies that can bring innovative solutions to this problem are valuable. The production of meat for human consumption is carbon intense, accounting for a significant portion of anthropogenic emissions each year. If we can convince (or force, wink, wink) people to eat plant-based meat substitutes, we can radically reduce our burden on the planet while simultaneously lessening animal cruelty.

As the story continues, Beyond Meat has uniquely cracked the code on making plant-based meat substitutes, is growing rapidly, and is pressing their first-mover advantage in this quickly growing category. Within 10-15 years, the world will consume radically less meat than it does today, and Beyond Meat is the best-positioned company to capitalize on this megatrend. As a reward for this narrative, Beyond Meat commands a truly stunning EV/revenue ratio of almost 20, at least a full order-of-magnitude higher than other comparable food companies. The only problem? The story is mostly nonsense.

Let me say upfront that, as a chicken, I really didn’t want to write this piece. I happen to agree that human consumption of meat is indeed a significant input into anthropogenic emissions and moving our population toward alternative sources of protein is a good thing. As we like to say around the chicken coop, “More eggs! Less wings!”

That part of Beyond Meat’s story holds up. The rest? Not so much.

Has Beyond Meat really cracked the code on plant-based meat substitutes in a unique and defensible way? Does it have a first mover advantage in this category? Is it rapidly growing? Is it even the best-in-breed pure play stonk? The official this-isn’t-trading-advice Doomberg opinions are strong no, strong no, not yet, and not for long.

Let’s take them in order. First and second up, Beyond Meat’s alleged uniqueness and early mover advantage. To supplement my analysis for this piece, I engaged in the type of hard-hitting original research you’ve come to expect from Doomberg: I personally visited every major grocery store chain in my pleasant little city. Each time I went into a store, two things stood out. First, it took a surprisingly long time to find where the fake meat products were located (both for those stored in freezers and those kept in open-air coolers). The premium freezer space was mostly allocated to other nutritious and popular items like frozen pizzas, ice cream, French fries, breakfast sausages, and popsicles. Same story with the open-air coolers – lots of beef, pork, and (unfortunately) chicken. Minimal real estate allocated to plant-based meat alternatives.

Second, when I did finally find where they were hiding the fake meat, it took a few moments to discover where the Beyond Meat products were positioned. The premium shelf space – at easy eye level in the freezers and near the high-traffic corners of the open-air coolers – were occupied by competitors like Gardein (owned by Conagra), Happy Little Plants (owned by Hormel), Sweet Earth (owned by Nestlé), Raised & Rooted (owned by Tyson), Impossible Foods (owned by Impossible Foods), and most-predominantly Morningstar Farms (owned by Kellogg), which has the all-time single greatest fake meat brand name: Incogmeato.

C’mon! Tell me Incogmeato isn’t the best product name you’ve ever heard?

Down near the bottom right of the freezers, I found a few scattered offerings from Beyond Meat, including some Beyond Beef Crumbles and packages of Beyond Breakfast Sausage. Over in the open-air cooler section, I did more easily find their flagship product Beyond Burgers, although the Impossible Burgers were far better positioned and more aesthetically pleasing. Overall, I’d estimate no more than 20% inventory share of fake meat for Beyond Meat at my local grocery stores and poor product placement. Somebody isn’t paying their slotting fees!

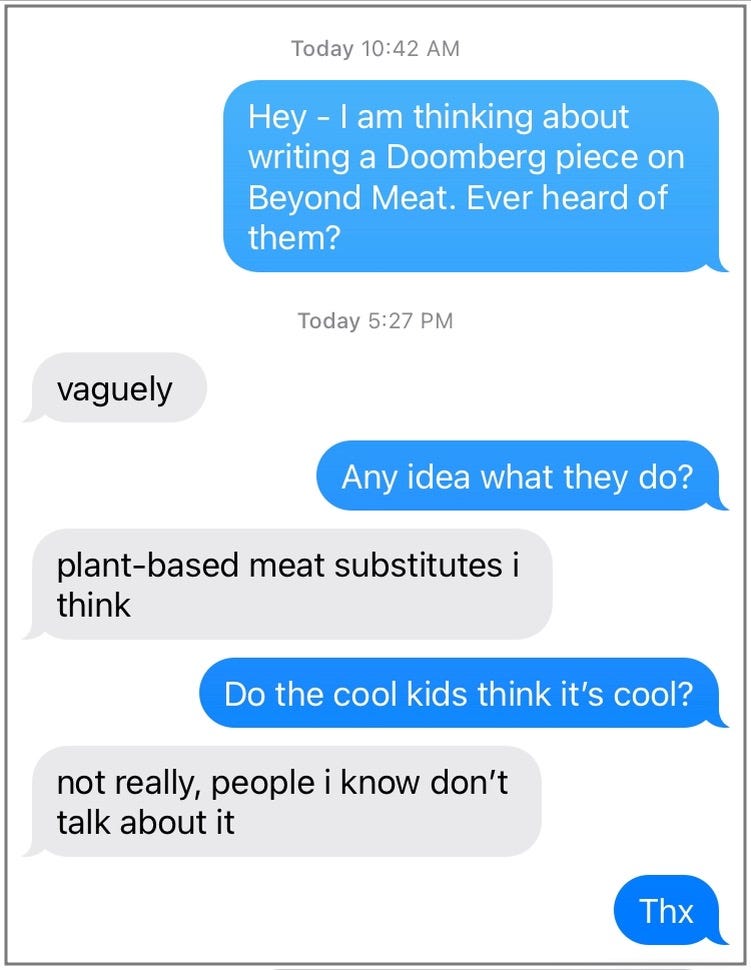

To validate my in-person assessments, I turned to the most reliable stonk indicator I know – my 16-year old son. While researching this piece, I had the following text exchange with him:

Don’t mind the long delay in his getting back to me – nights are for video games and days are for sleeping, after all. The key point here is what the cool kids are saying. With regard to Beyond Meat, they aren’t saying much. This isn’t the stuff of durable first movers.

Is Beyond Meat really growing? Not lately, although both the company’s guidance and street expectations do have some decent growth priced in over the next few years. For the past seven quarters, Beyond Meat has oscillated around $100 million of revenue per quarter. It has often had to cut prices to achieve these numbers.

Beyond Meat reports their quarterly earnings next week (August 5), and the street is calling for quarterly revenue of $140 million, which would represent solid sequential and year-over-year revenue growth to be sure. With the stock trading at $123 a share as of yesterday, a blow-out quarter could cause it to stonkify (i.e., to go up substantially), but that’s not really the point of this piece. Beyond Meat’s revenue could grow tenfold in the next five years and it would still be overvalued using The Stupid Way™ valuation techniques.

The real issue with Beyond Meat is that it won’t be the best-in-breed story stonk for much longer. That title will pass to Impossible Foods once it finds its way to the public markets. You see, as part of my research for this piece, I read several of Beyond Meat’s earnings call transcripts and watched numerous interviews with its CEO, Ethan Brown. Ethan seems like a solid enough guy. He speaks in a calm demeaner, knows his business inside out, and is serious about the task of building a real business from the ground up. He talks about supply chains, factory build outs, marketing strategies, pricing decisions, and funding strategies with a comfortable fluency.

And therein lies the problem. He doesn’t really speak stonk.

The CEO of Impossible Foods, on the other hand, is a real stonk ninja. Unlike Ethan Brown, Pat Brown isn’t shy about comparing his company favorably to Tesla, which is run by King Stonkster™ Elon Musk. Go re-read the opening quote of this piece. Impossible Foods intends to do for your backyard barbeque what Tesla has done for your garage. I’m not quite sure what that last sentence means exactly, which is odd because I wrote it, but you get my point (I think).

In a recent interview with the Washington Post entitled “Why the CEO of Impossible Foods thinks he can eliminate all animal-based meat in 15 years”, Pat Brown opines:

“We are in the very late stages of an absolute catastrophic collapse of global biodiversity. The total number of living wild mammals, birds, reptiles, amphibians and fish on Earth today is less than a third of what it was 50 years ago. And it’s almost entirely due to our use of animals as a food technology. The overwhelming driver of the collapse of terrestrial species is habitat destruction and degradation. More than 80 percent of the land footprint of humanity is land used for animal agriculture. Every city on Earth sits on less than 1 percent of the planet’s land. The land footprint of animal agriculture, when you count feed crops, permanent pastures and temporary grazing on pasture is 45 percent of Earth’s land area. And you can see that the demand for meat and dairy foods is not going down, it’s going up faster than population growth. Therefore, the only way you can expand production is by deforestation, and 95 percent of the deforestation in the Amazon is clearing of land for animal agriculture.”

That, ladies and gentlemen, is stonktastic stuff! If you don’t buy Impossible Foods, you must hate animals and forests. Hey you – yeah you, the one eating that Big Mac. Do you hate global biodiversity or something? Get your act together, man. I can confidently predict that when Impossible Foods finds its way to the public markets, either by a traditional IPO or via a SPAC transaction, Pat is going to be the Elon Musk of fake meat. He’ll also be a billionaire.

What does the future hold for Beyond Meat? If there’s truly a pot of gold at the end of the fake meat rainbow, the incumbent players will eventually press their inherent advantages and soak up most of the bounty. Once Impossible Foods makes its debut on the stock exchanges, it will displace Beyond Meat as the best-in-breed stonk. In short, Beyond Meat will get ground down from above by the big food companies and out-stonked from below by Impossible Foods. Eventually.

If you enjoy Doomberg, subscribe and share a link with your most paranoid friend!

We appreciate the huge sacrifices you've made in braving the elements of your local grocers to bring us the hard hitting journalism we expect.

Your analysis is purely anecdotal...The only factor to consider is that Impossible Burgers are banned in European countries and China because they are made with GMO soy...that fact is mentioned in this article> https://www.ecowatch.com/understanding-gmos-2653417556.html